AirBit Club Execs – Flagged as Scam by PH SEC in 2018 – Plead Guilty to Fraud Charges in the US

The group collected around $100 million over five years, promising investors guaranteed passive income and profits on any purchase.

Subscribe to our newsletter!

- Six AirBit Club executives have pled guilty to fraud and money laundering charges, facing a maximum sentence of 20 to 30 years of imprisonment for each charge.

- The group collected around $100 million over five years, promising investors guaranteed passive income and profits on any membership purchased, but instead spent the funds on personal luxuries.

- The Philippines Securities and Exchange Commission (SEC) previously issued an advisory against AirBit Club in 2018 for offering illegal online investments to the public.

Six executives of the AirBit Club, a bitcoin investing scheme, have pled guilty to a series of fraud and money laundering charges in the U.S. for their “ponzi scheme” that collected about $100 million for over five years. Their charges are each carrying a maximum sentence of 20 to 30 years of imprisonment.

The culprits are identified as: co-founders Pablo Renato Rodriguez, pleaded guilty on March 8th and Gutemberg Dos Santos pleaded guilty in October 2021–he was extradited to his home countryPanama in 2020. Cecilia Millan, Karina Chairez, and Jackie Aguilar, the promoters of the platform, pleaded guilty earlier this year. Lastly, the attorney who helped the founders launder money Scott Hughes pleaded guilty on March 2.

They all pleaded guilty to charges of wire fraud conspiracy, money laundering conspiracy and bank fraud conspiracy. As part of their plea, the defendants shall forfeit their ill-gotten gains, including U.S. currency, bitcoin and real estate.

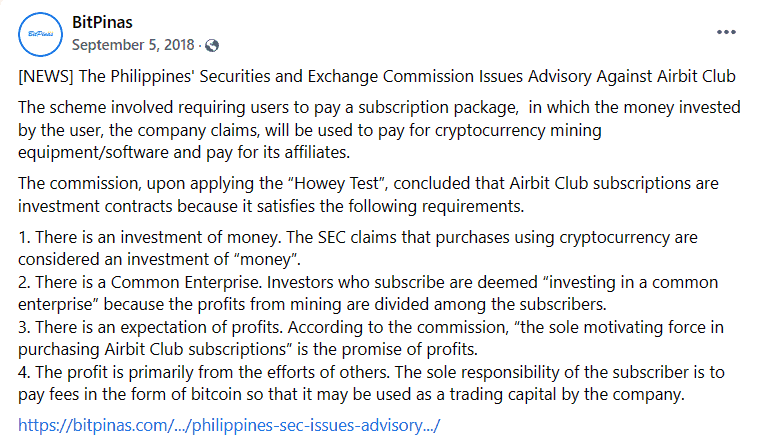

In 2018, the Philippines Securities and Exchange Commission (SEC) issued an advisory against AirBit Club noting that it offers illegal online investments to the public. (Read more: Philippines SEC Issues Advisory Against Airbit Club)

These individuals enticed their investors with a promise that their money would be invested in a lucrative mining operation and they would make guaranteed passive income and profits on any membership purchased. However, the funds were instead spent on the executive personal gain such as “cars, jewelry and luxury homes” which they also utilized as a “more extravagant expos to recruit more victims.”

“The defendants took advantage of the growing hype around cryptocurrency to con unsuspecting victims around the world out of millions of dollars with false promises that their money was being invested in cryptocurrency trading and mining… Instead of doing any cryptocurrency trading or mining on behalf of investors, the defendants built a Ponzi scheme and took the victims’ money to line their own pockets,” explained U.S. Attorney Damian Williams.

As of writing, there is still no verdict but each of them could face a maximum sentence of 70 years in prison

The Commission has been actively attempting to regulate the increasing numbers of fraudsters trying to leverage on the rising crypto industry in the country and entice investors. The SEC published a draft version of the implementing rules and regulations (IRR) of the Financial Products and Services Consumer Protection Law (Republic Act 11765) last January. Once implemented the SEC will be able to impose stricter penalties on scammers and Ponzi schemes. (Read more: STRONGER FINANCIAL REGULATIONS: SEC Issues Draft To Impose Stricter Penalty vs Scammers, Ponzi Schemes)

Moreover, the Commission is also set to have joint research and capacity-building projects focusing on cryptocurrency and financial technology regulation with the University of the Philippines Law Center (UPLC) through the University of the Philippines Legal Center Research Program. (Read more: SEC Partners with UP Law Center for Joint Research on Crypto, Fintech Regulations)

The Bangko Sentral ng Pilipinas (BSP) is active in trying to protect the consumers. Last month, they urged users to report any issues with licensed Virtual Asset Service Providers (VASPs) directly to the central bank. VASPs are entities that facilitate exchange between virtual assets and fiat currencies, exchange between virtual assets, transfer of virtual assets, and custody of these assets. (Read more: BSP Makes it Easier to Report Problems with Locally-Licensed Crypto Exchanges)

This article is published on BitPinas: AirBit Club Execs – Flagged as Scam by PH SEC in 2018 – Plead Guilty to Fraud Charges in the US

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.