SEC Flags Down Unregistered White Dragon Investment Group

SEC warns against White Dragon Investment Group’s unauthorized investment scheme and solicitation on social media.

- The SEC issued a warning about the illegal solicitations made via social media by White Dragon Investment Group and its head, Justin Arvin Santos Atendido.

- The investment group claims involvement in various business sectors like real estate, food, franchising, leisure, gaming, poultry, and private investments.

- The SEC highlighted that its offerings are securities and should be registered before the public offering, as per the Securities Regulation Code.

With its campaign to protect Filipinos from the risk of investing in unlicensed entities, the Securities and Exchange Commission (SEC) warned the public against the illegal investment scheme of the White Dragon Investment Group and its head, identified as Justin Arvin Santos Atendido, on different social media platforms.

White Dragon Investment Group Scheme

On its Facebook Page, White Dragon Investment Group claims to be involved in initiatives related to the growth and enhancement of its diverse business segments. These encompass real estate development, food and beverage, franchising, leisure and gaming services, and poultry and eggs, alongside private investments.

In fact, in its recent post on August 19, it even introduced a new project called “Royal Villa of Buddha,” which the group named a “luxurious villa” located in the Sierra Madre Mountains that offers “breathtaking views,” “luxurious amenities,” and can accommodate up to 25 guests.

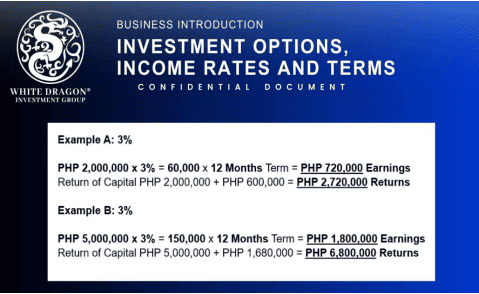

Moreover, the Commission found out that White Dragon Investment Group recruits investors by offering them the opportunity to invest a minimum of ₱100,000 for a 3% monthly interest, or a total of 36% annual return on investment. The investment money is said to support the group’s initiatives.

SEC: White Dragon Investment Group Unlicensed, Unregistered

Upon its investigation, the SEC has pointed out that the entity’s investment offer is a type of security, as it meets the definition of an investment contract under the Securities Regulation Code. Thus, it must be registered with the Commission before it can be offered to the public.

However, the regulatory agency also stressed that its records indicate that White Dragon Investment Group is not registered with the Commission. Furthermore, the securities in the form of investment contracts that it is offering to the public are likewise not registered with the Commission, in violation of Sections 8, 26, and 28 of the Securities Regulation Code.

Accordingly, the SEC stressed that the investment group violated the Financial Products and Services Consumer Protection Act (FCPA), which prohibits investment fraud, which includes Ponzi schemes and other schemes that promise profits from investor contributions. It also prohibits the offering or sale of investment schemes without a license.

Consequently, the Commission reminded individuals and/or organizations that severe penalties will be imposed for any violations of the Securities Regulation Code, the FCPA, and other laws, rules, and regulations enforced by the Commission.

“Those who act as salesmen, brokers, dealers or agents of WHITE DRAGON INVESTMENT GROUP vis-à-vis JUSTIN ARVIN SANTOS ATENDIDO in selling or convincing people to invest in what appears to be an investment scheme being offered by the said entity, including solicitations and recruitment through the internet may be prosecuted and held criminally liable under Section 28 of the SRC and Section 11 of the FCPA,” the SEC warned. It can be noted that the penalties for the two offenses are a maximum fine of ₱5 million 21 years of imprisonment, or both.

The Commission has then emphasized that the public should stop and not invest in White Dragon Investment Group or similar schemes, as well as exercise caution with anyone soliciting investments on their behalf.

SEC Activities Recently

Also this month, the SEC issued an advisory against B2B Trading Center OPC and its officers, including Serapion Dimasaka Sergio, Jr. (also known as Jhun Sergio) and Cesar Ramirez. The Commission stated that the entity is soliciting investments through its Go Diamond.On-line Program, which is not registered with the Commission.

In July, it organized a roadshow in Manila to promote the capital market as a solution to the credit gap for MSMEs in the Philippines, where crowdfunding was highlighted as a suitable and convenient way for MSMEs to raise funds for expansion.

Moreover, Commissioner Kelvin Lester Lee shared updates to the country’s crypto regulations, emphasizing investor protection, and disclosed that the new name for the SEC’s cryptocurrency regulation is now “Digital Asset Security Service Providers Rules.”

This article is published on BitPinas: SEC Flags Down Unregistered White Dragon Investment Group

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.