BDO Joins CBDC Pilot Study for US – PH Remittance

Discover how digital currencies may transform cross-border payments, making them faster and more efficient, thanks to this study by the Digital Dollar Project, Western Union, Accenture, and Philippine bank BDO.

- BDO Unibank, the Philippines’ largest bank, collaborates with Western Union, Accenture, and the Digital Dollar Project for a CBDC pilot study in US-Philippine remittances.

- The pilot indicates that CBDCs could complete payments in under ten seconds, offering reduced credit risks, decreased costs, and increased money portability.

- Key stakeholders express optimism about the pilot’s potential to transform cross-border transactions and financial inclusion through CBDCs.

In a statement sent to BitPinas, Banco De Oro or BDO Unibank, the Philippines’ largest bank, confirmed that it collaborated with Western Union, Accenture, and the Digital Dollar Project for a pilot study focused on using Central Bank Digital Currencies (CBDC) in cross-border remittances.

The report is viewable in this article.

The Digital Dollar Project is a non-profit organization that encourages research and public discussion on the potential advantages and challenges of a U.S. CBDC.

Introduction to the Pilot Study

The pilot, which targeted the US-Philippine remittance corridor (a corridor with a lot of activity, given that the country receives a large volume of inward remittances from the US), aimed to determine if using CBDC in remittances between the two countries would be more efficient than the current remittance methods.

(Read more: ANC Report: BSP Still Pursuing CBDC Project)

Initial results reveal that CBDCs could complete payments in under ten seconds. Both wholesale CBDCs (between financial institutions) and retail CBDCs (for customers) are used in the pilot.

(Side note: Interestingly, the report noted a remark from the Bank of International Settlements (BIS), often referred to as the central bank of all central banks, which raised concerns about the increasing use of “shadow payments” and referred to cryptocurrencies as one such form of payment. Although blockchain was never mentioned in the report, it does refer to the use of distributed ledger technology to make the experiment possible.)

BDO’s Role in the CBDC Project

In a statement, BDO’s Senior Vice President Geneva Gloria said the universal bank joined the pilot project to explore the benefits of a digital dollar and PHP CBDC (Philippine Peso Central Bank Digital Currency).

“Our goal was to provide policymakers, other industry leaders, and the general public with a better understanding of the possible opportunities the central bank digital currencies present in the cross-border remittance landscape.”

(Read more: Finance Chief Diokno: This is Not the Right Time for CBDCs)

The Experiment Explained

The pilot study simulated a remittance from a customer using Western Union in the US and then transferring the money to a customer in the Philippines via UnionBank.

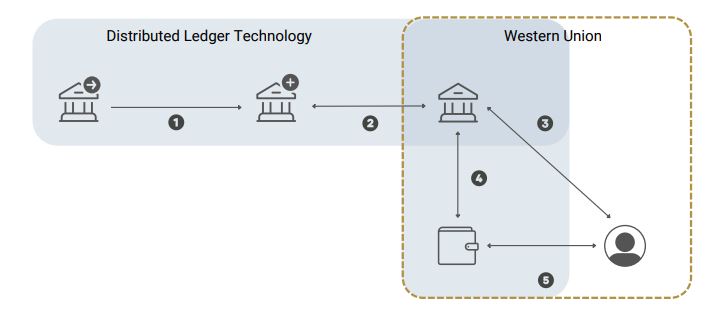

The first part is issuing the CBDC to financial institutions:

- Central Bank issues digital dollars to commercial bank.

- Western Union’s commercial bank provides access to digital dollars.

- Western Union conducts KYC/AML to onboard customer.

- Western Union hosts customer’s wallet.

- Customer funds or withdraws traditional fiat in exchange for digital dollars.

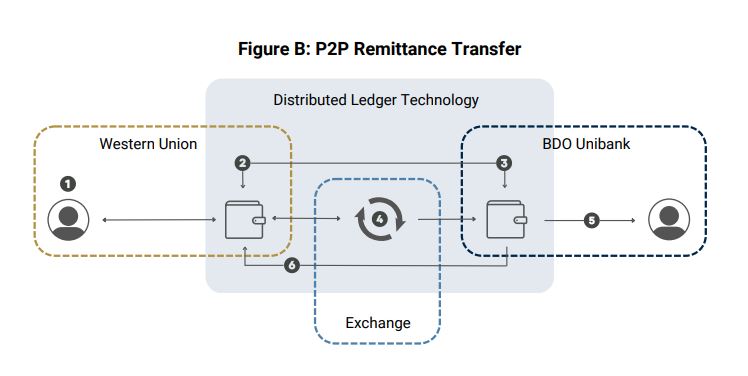

For the Remittance Transfer:

- Sender initiates payment, confirms details.

- Verification of balance in Sender’s wallet.

- Verification of known Recipient.

- Value atomically exchanged between wallets.

- Recipient notified of payment.

- Confirmation sent back to Sender.

Initial Results and Benefits

The CBDC pilot study identified potential benefits for retail customers:

- Reduced credit risks for customers and financial institutions.

- The value transfer is settled in a single transaction, so it alleviates the costs of capital held in pre-funded accounts, which is how remittances usually operate.

- Increased portability of money.

- The use of permissioned ledger means all transactions are visible on the chain.

For BDO, Gloria said digital currencies transform how financial institutions think about remittances and financial inclusion. “We observed that CBDCs have the potential to offer a new way to send remittances across borders faster and cost efficiently and provide immediate settlement between parties—all of which are crucial to cross border remittances for our customers.”

Kevin Mole, Global Head of Digital Assets at Western Union says the pilot study has identified the advantages of CBDCs, thus “laying the groundwork for ongoing evaluations of the feasibility and viability of utilizing retail CBDCs for cross-border remittances.”

(Read more: BIS: CBDCs Will Be the Future of Monetary Systems, Are Better than Crypto)

Jennifer Lassiter, Executive Director of The Digital Dollar Project, said the pilot study is an important step in understanding the impact of retail CBDC.

“With the support of Western Union and other DDP partners, we will continue to generate the needed research and data to map feasible, real-world use cases that speak to financial institutions, policymakers, and technological partners,” Lassitter said.

This article is published on BitPinas: BDO Joins CBDC Pilot Study for US – PH Remittance

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.