Expert BTC Price Predictions in 2023: $5,000, $10,000, or $50,000?

Find out what experts predict for BTC prices in 2023, including forecasts from Standard Chartered, Mark Mobius, and Tim Draper.

Subscribe to our newsletter!

- Messari analyst Tom Dunleavy’s recent data chart shows that 10 known public miners sold almost all the BTC they mined in 2022, which could be a good sign for Bitcoin.

- Some experts have made predictions about BTC’s value in 2023, including Standard Chartered forecasting a fall to $5,000, Mark Mobius predicting $10,000, and Carol Alexander forecasting $30,000 in Q1 and $50,000 in Q3 or Q4.

- Factors that could affect BTC’s price include miner capitulation, the Bitcoin Halving Cycle set to happen in 2024, and rising interest rates and tighter monetary policy from the U.S. Federal Reserve.

The recent data chart revealed by Messari analyst Tom Dunleavy showing that 10 known public miners sold roughly all the BTC they mined throughout 2022 is “historically a good sign for Bitcoin,” Vijay Ayyar, the vice president of corporate development at crypto exchange Luno, said in an interview with CNBC.

“In prior down markets, miner capitulation has usually indicated major bottoms. Their cost to produce becomes greater than the value of Bitcoin, hence you have a number of miners either switching off their machines… or they need to sell more Bitcoin to keep their business afloat,” Ayyar explained.

With this, some of the experts in the crypto space have publicized their predictions about the value of BTC for 2023, since it came from a bearish trend last 2022 due to the crypto winter.

“If the market reaches a point where it’s absorbing this miner sell pressure sufficiently, one can assume that we’re seeing a bottoming period,” Ayyar added.

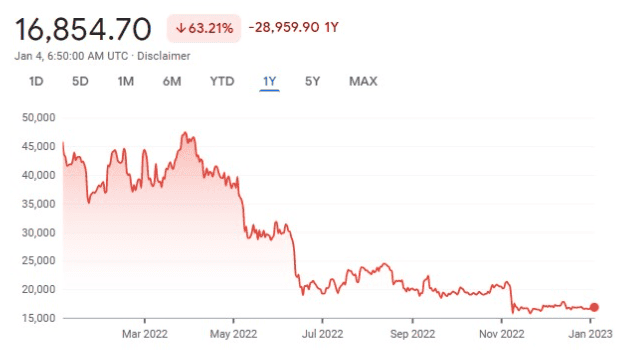

As of this writing, 1 BTC is equivalent to $16,854.70, about 63% down from exactly a year ago.

However, one of the key factors that the experts are looking at that will greatly affect BTC’s price is the Bitcoin Halving Cycle which happens every four years.

The last halving of BTC was in May 2020, and in 2021, the market became bullish and BTC reached an all-time high of above $68,000.

Now that the next halving is set to happen in 2024, what should BTC hodlers expect for the price of the first-ever cryptocurrence?

Standard Chartered Bitcoin Price: $5,000

Standard Chartered, a UK-based multinational bank with operations in consumer, corporate, and institutional banking and treasury services, warned the public that the worst is yet to come this year.

In a December study, Standard Chartered Global Head of Research, Eric Robertsen, concluded that BTC may fall to as low as $5,000.00. One of the reasons he mentioned is that one of the bank’s lists of surprises that are under-appreciated by markets would represent a 70% drop from current prices:

“Yields plunge along with technology shares. And while the Bitcoin sell-off decelerates, the damage has been done. More and more crypto firms and exchanges find themselves with insufficient liquidity, leading to further bankruptcies and a collapse in investor confidence in digital assets.”

Mark Mobius BTC Price Prediction: $10,000

Mark Mobius is a veteran investor and was known for leading Templeton Emerging Markets, one of the first global emerging markets funds, for 30 years after value investor John Templeton asked him.

Mobius’ 2022 prediction for BTC is $10,000, and he did not change it; he is still sticking to his $10,000 price call for 2023.

“With higher interest rates, the attraction of holding or buying Bitcoin or other cryptocurrencies becomes less attractive since just holding the coin does not pay interest,” the veteran investor clarified, highlighting that one of his bases in making his prediction is the rising interest rates and general tighter monetary policy from the U.S. Federal Reserve.

Carol Alexander: $50,000

Carol Alexander is a Professor of Finance at Sussex University and claims to be an expert in crypto asset and derivatives markets, financial risk analysis, high-frequency data analysis, blockchains, pricing and hedging financial instruments, volatility analysis, investment strategies, benchmarking, and portfolio management.

Her last year’s prediction was that BTC would slip to $10,000, which was not far from the year-low of $15,799.60 last November.

And this year, her prediction is bullish: $30,000 for the first quarter and $50,000 by the third or fourth quarter.

“There will be a managed bull market in 2023, not a bubble, so we won’t see the price overshooting as before,” Alexander explained.

According to the finance professor, the market’s recovery from the major and side effects of the FTX debacle could be the catalyst for the bullish BTC this year.

“We’ll see a month or two of stable trending prices interspersed with range-bound periods and probably a couple of short-lived crashes,” Alexander concluded, adding that “whales,” or those who hold large amounts of BTC, are another factor driving up the price of BTC.

Antoni Trenchev (Nexo): $100,000

Businessman Antoni Trenchev was a former member of the National Assembly of the Republic of Bulgaria from 2014 until 2017. Currently, he is known for using crypto in his businesses, especially being the executive officer of crypto lending platform Nexo.

He is one of the experts that released their predictions in a very early manner, predicting a $100,000 BTC price because, despite the recent sobering moment, “Bitcoin was on a ‘positive path’ earlier in 2022, with institutional adoption rising, but a few major forces interfered.”

Tim Draper: $250,000

Another veteran investor went wild with his predictions about the 2023 BTC price.

Tim Draper, who founded thirty Draper venture funds, Draper University, Bizworld, and two statewide initiatives, stressed that BTC will be worth $250,000 at the end of 2022. But because of the collapse of FTX, he will extend the timeline of his prediction until mid-2023.

“My assumption is that since women control 80% of retail spending and only one in seven Bitcoin wallets are currently held by women that the dam is about to break,” said Draper, who also affirmed the fact that BTC would need to rally up to 1,400% to reach his predictions.

The investor also expressed his intuition that the BTC Halvening Cycle will have an early, good benefit for the crypto prices this 2023:

“I suspect that the halvening in 2024 will have a positive run.”

However, despite all of these predictions, financial analyst Laith Khalaf concluded that he would not be surprised if BTC’s value will fall to $5,000.00 or even increased to $50,000.00 because the market is too volatile:

“We could be sitting here talking this time next year, and it could be at $5,000 or $50,000; it just wouldn’t surprise me because the market is so heavily driven by sentiment.”

This article is published on BitPinas: What to Expect for BTC Prices in 2023: $5,000, $10,000, or $50,000?

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.