CoinGecko’s 2022 Annual Crypto Industry Report: Crypto Market Lost At Least 50% of Value

The 2022 crypto space ended with a value of just $829 billion, about 65% lower compared to last year’s $2.4 trillion market cap.

Subscribe to our newsletter!\

Editing by Nathaniel Cajuday

- Crypto aggregator CoinGecko has released its 2022 Annual Crypto Industry Report:

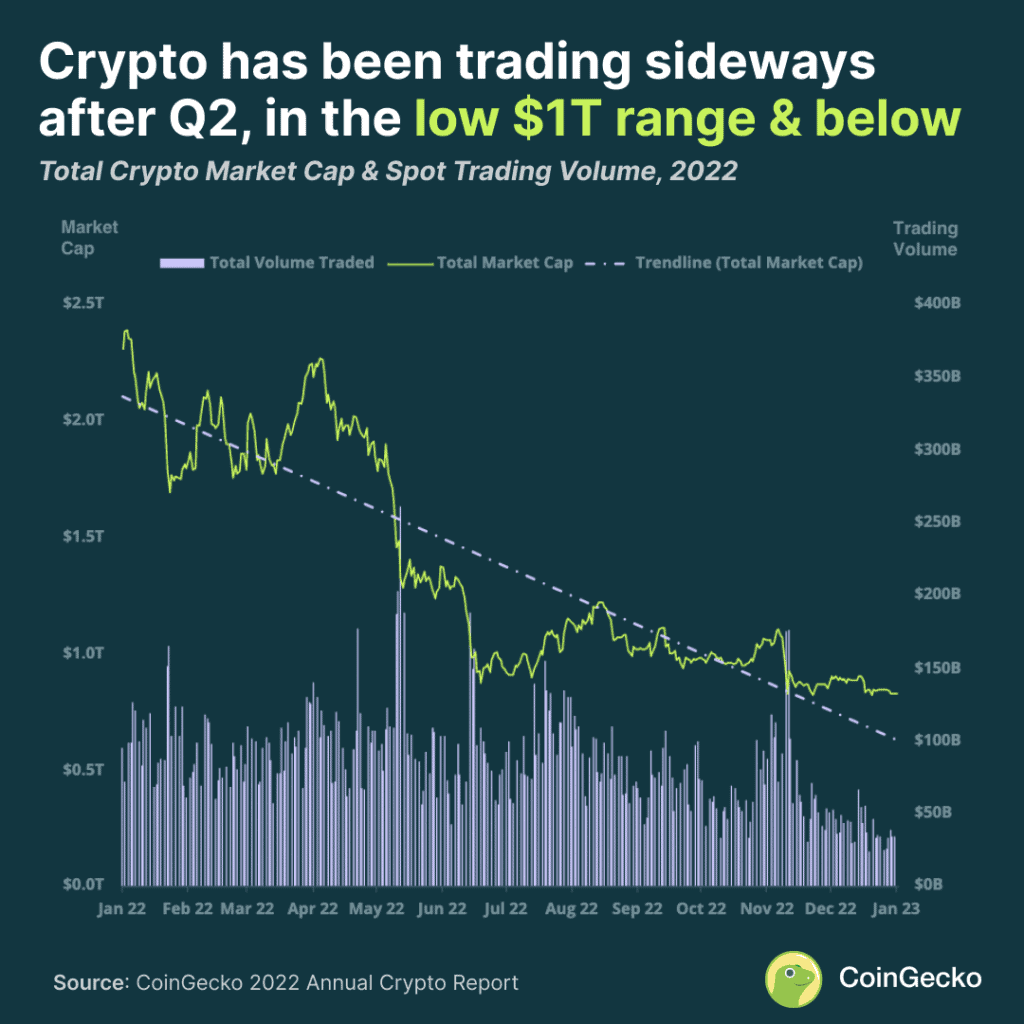

- The crypto market has been trading in a $1 trillion range after the second quarter.

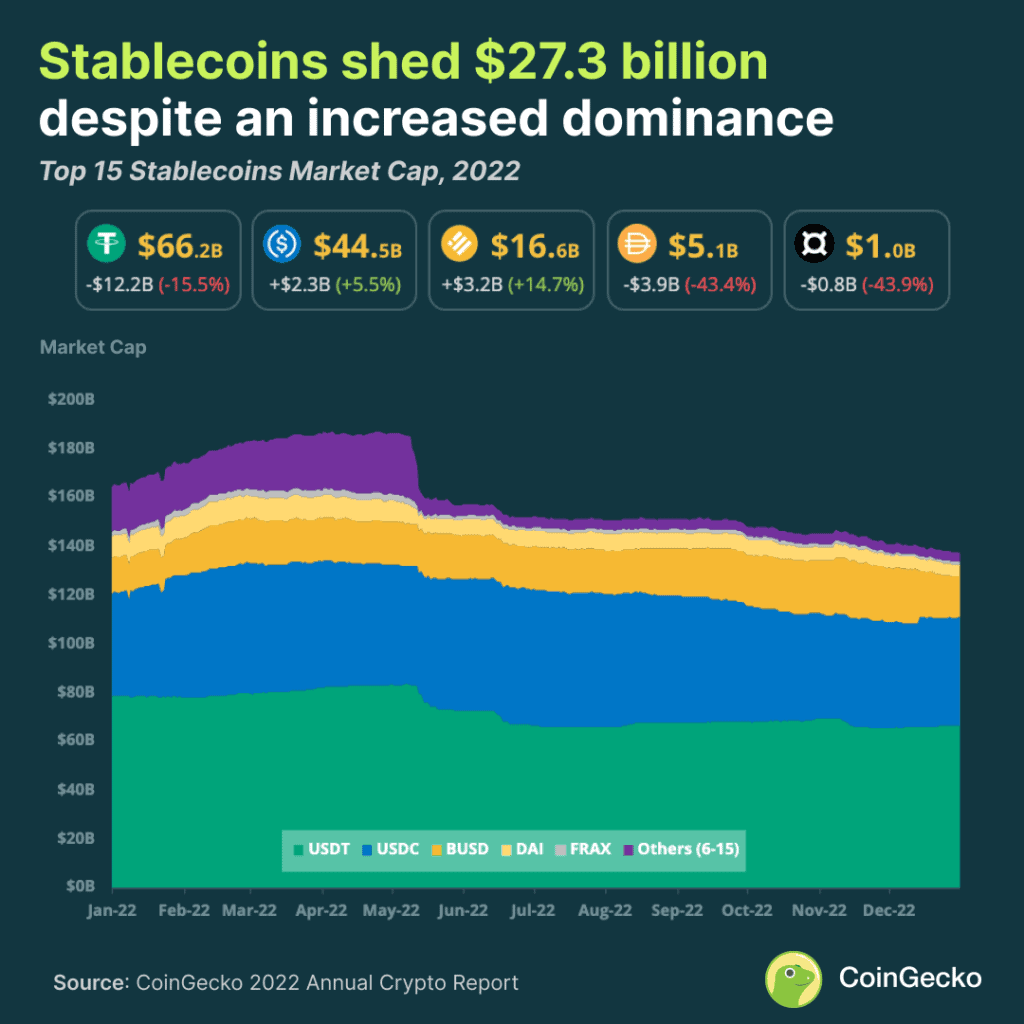

- Stablecoins went down by $27.3 billion despite an increased dominance; though, USDC and BUSD experienced an increase in market cap.

- The FTX debacle has left over one million estimated depositors, creditors, and investors empty.

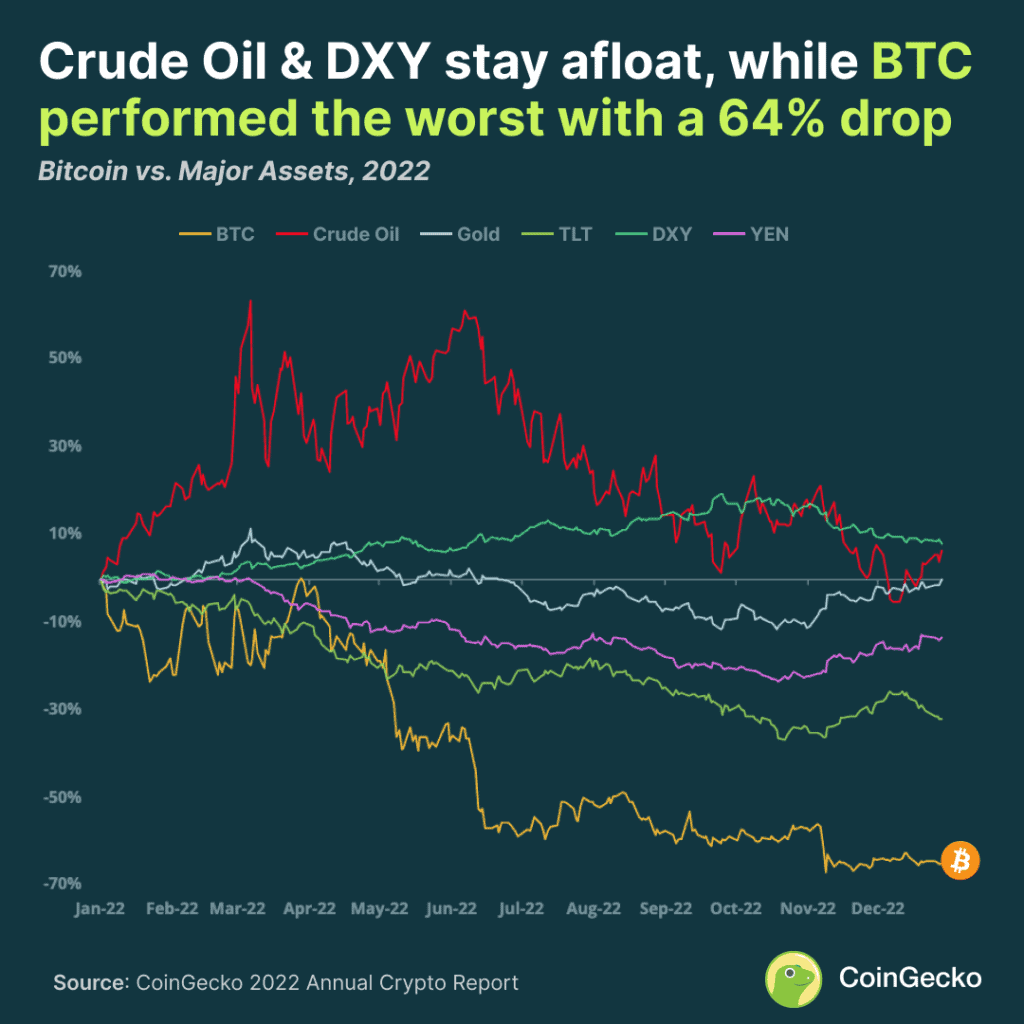

- BTC was the worst-performing asset globally, with a 64.2% drop.

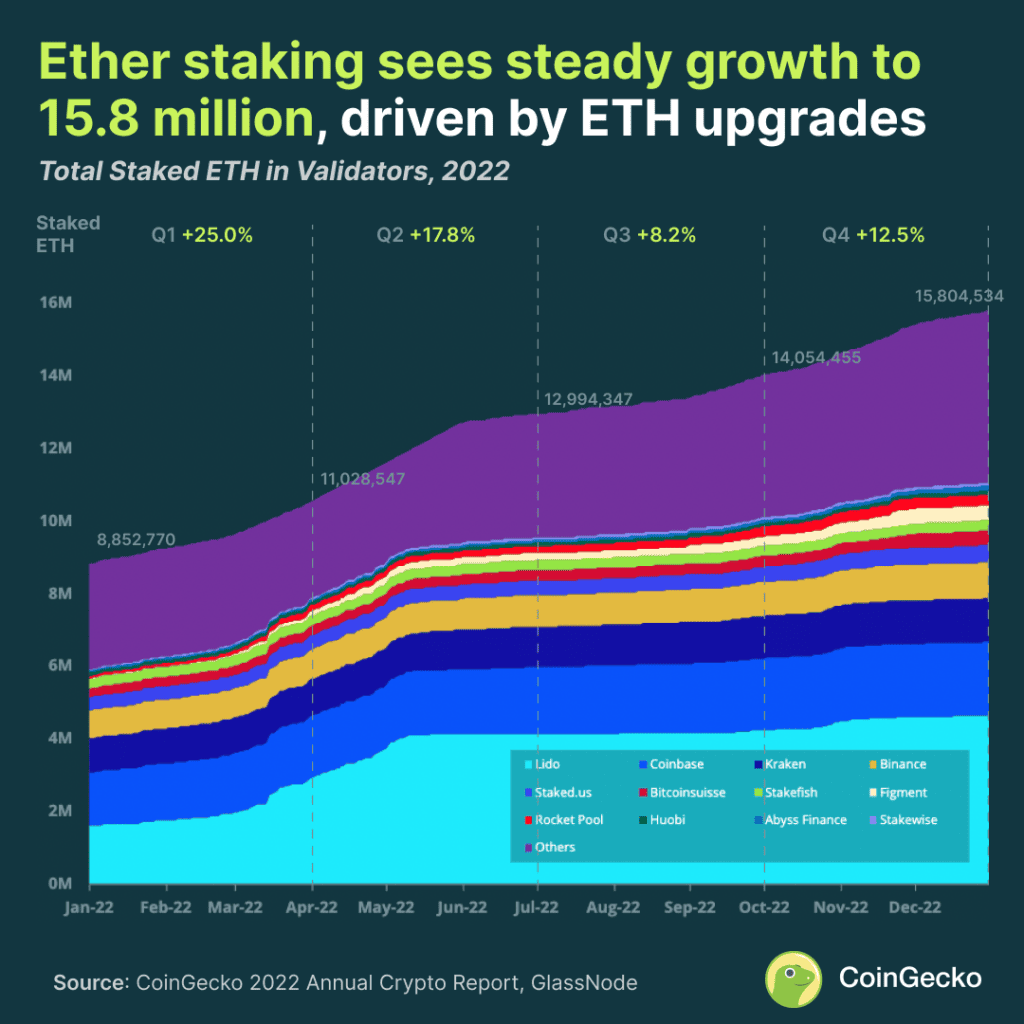

- Ether staking sees steady quarterly growth to 15.8 million ETH by year-end.

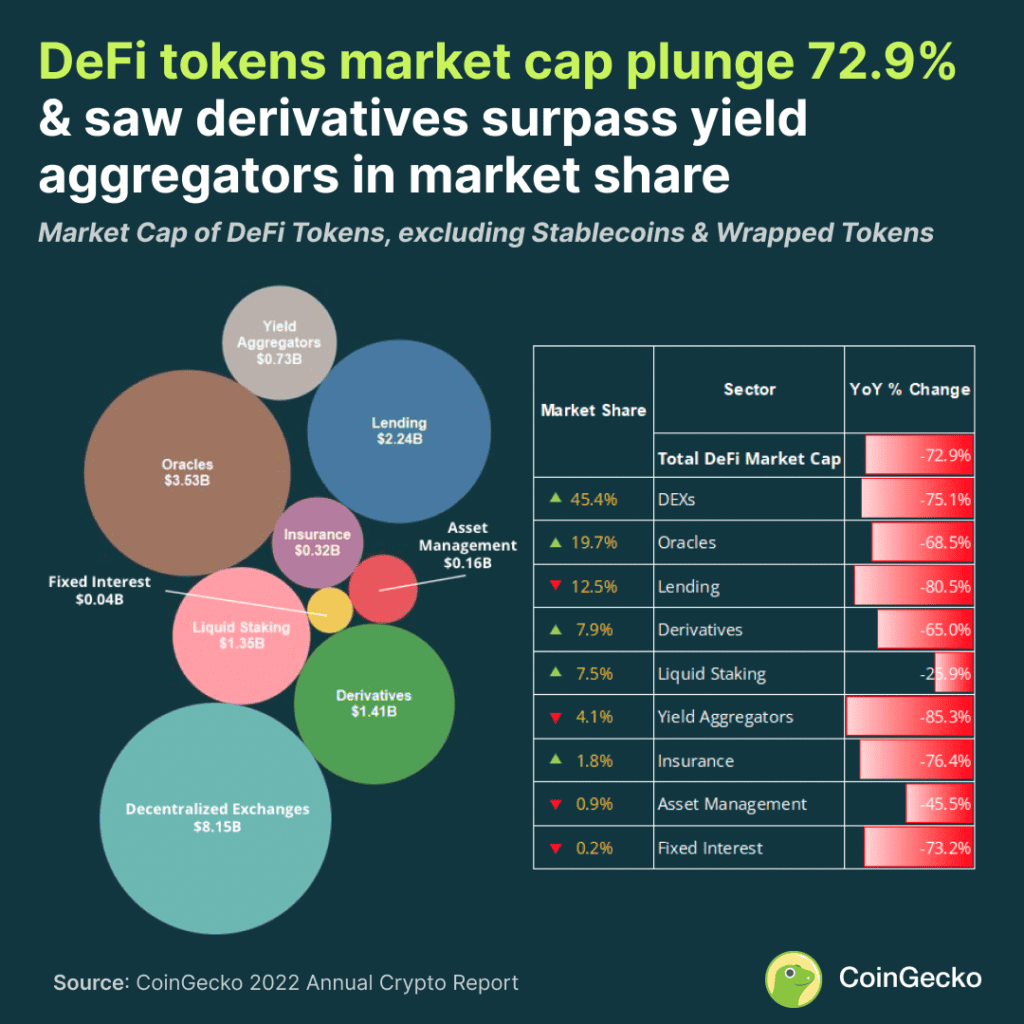

- The market cap of DeFi tokens, excluding stablecoins and wrapped tokens, fell by 72.9%.

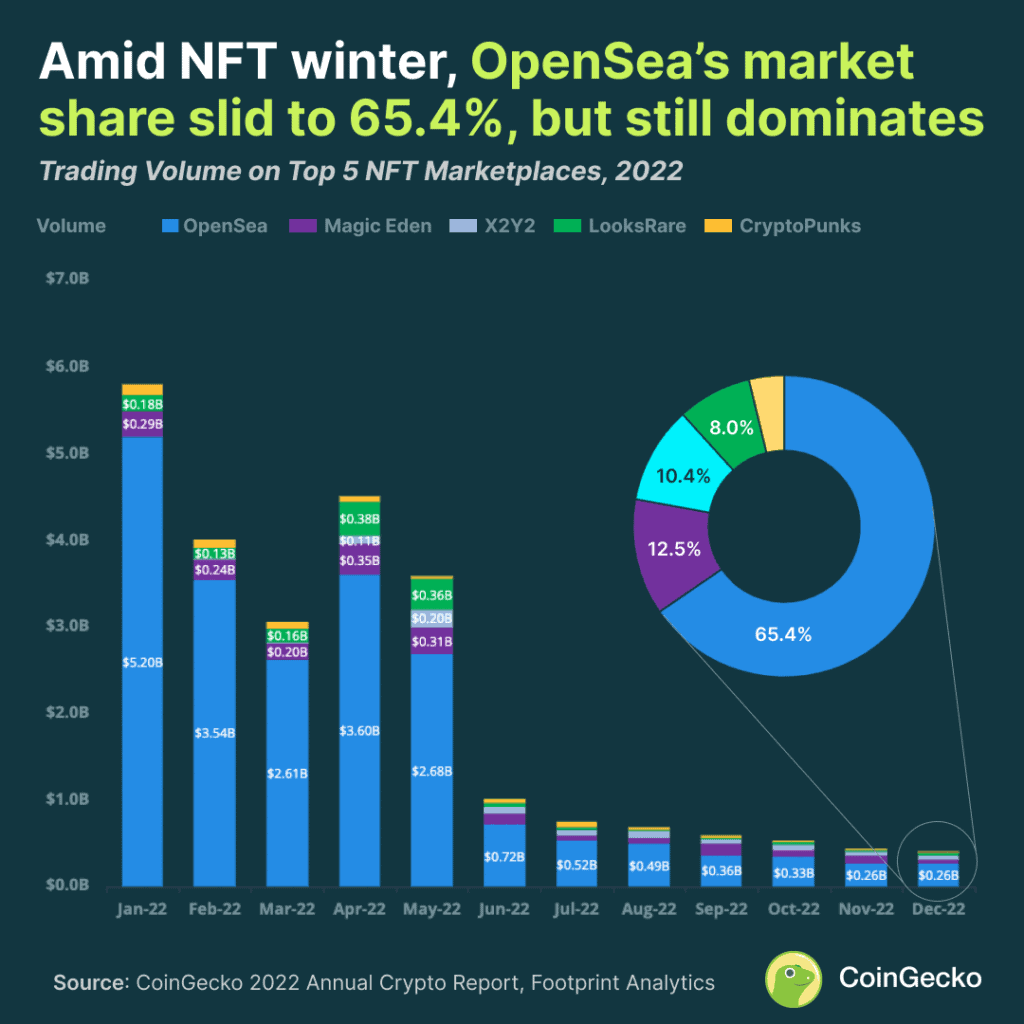

- Amid NFT winter, OpenSea is still the most dominant NFT marketplace.

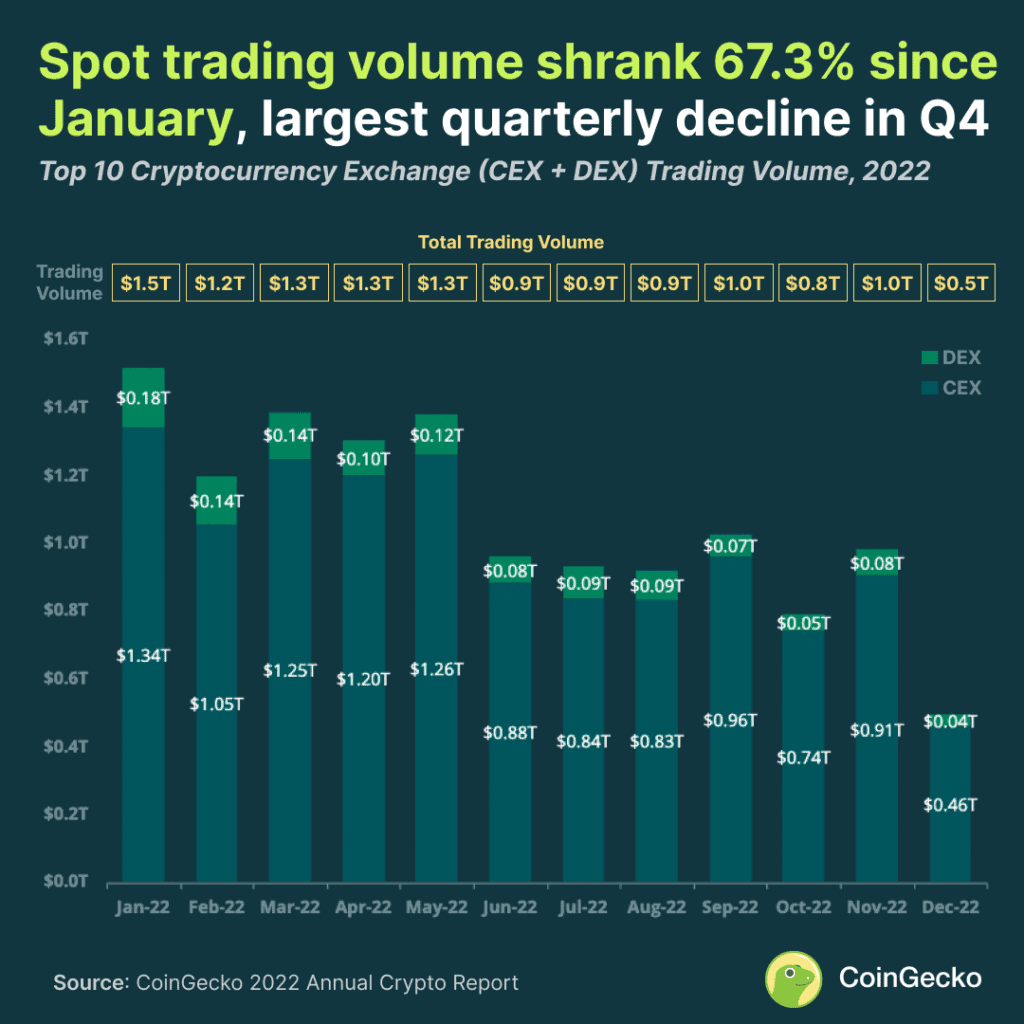

- Spot trading volume also fell by 67.3% in the early part of the first quarter and experience a 21.2% quarterly drop in Q4.

To wrap up the crypto industry in the recent year, CoinGecko, an independent cryptocurrency aggregator, has released its 2022 Annual Crypto Industry Report, revealing that the total crypto market capitalization lost more than half its value.

According to the report, the 2022 crypto space ended with a value of just $829 billion, which is about 65% lower than a year ago. In 2021, the overall industry market capitalization grew by at least three times, recording a $2.4 trillion market cap—even briefly reaching an all-time high of $3 trillion.

According to the report, the 2022 crypto space ended with a value of just $829 billion, which is about 65% lower than a year ago. In 2021, the overall industry market capitalization grew by at least three times, recording a $2.4 trillion market cap—even briefly reaching an all-time high of $3 trillion.

Following the major collapses that happened to crypto firms in 2022, the report focused on examining the state of the crypto market and its various sectors. As per the report, trading volumes were down, with non-fungible tokens and DeFi among the hardest-hit sectors. Stablecoins also did not have a stable performance throughout the year.

Bitcoin, the largest cryptocurrency by market cap, also did not perform well, following increasingly severe macroeconomic conditions.

“2022 marked a turning point for the crypto industry—one that flushed out unsustainable excesses from the bull run. In this new year, we hope to see crypto slowly make a recovery, with more efforts going towards rebuilding trust and credibility,” said Bobby Ong, COO and co-founder of CoinGecko.

CoinGecko 2022 Annual Crypto Industry Report Highlights

1. After significant losses in Q2, the crypto market consolidated at half the value

CoinGecko pointed out that the challenges from global macroeconomic conditions were compounded by the crypto industry’s debacles, bankruptcies, and exploits.

CoinGecko pointed out that the challenges from global macroeconomic conditions were compounded by the crypto industry’s debacles, bankruptcies, and exploits.

Its data then revealed that the total crypto market capitalization started the year at $2.3 trillion and dropped below $1 trillion in Q2 for the first time since August 2021. The markets continued to plunge sideways through the second half, ending the year 64.1% lower at $829 billion.

In another report by the Block’s Data Dashboard, the daily spot market trading volume in December 2022 for cryptocurrency exchanges fell below $10 billion for the first time since December 17, 2020. (Read more: Daily Exchange Volume Fell Below $10B Starting Christmas Eve)

2. Stablecoins gained in crypto dominance but lost from net outflows

For 2022, CoinGecko highlighted that the top three stablecoins, Tether (USDT), USD Coin (USDC), and Binance USD (BUSD), increased their dominance in the crypto market.

For 2022, CoinGecko highlighted that the top three stablecoins, Tether (USDT), USD Coin (USDC), and Binance USD (BUSD), increased their dominance in the crypto market.

Although it can be remembered that Terra’s algorithmic stablecoin, UST, the largest stablecoin by market cap, as well as its crypto, LUNA, collapsed last May, which resulted in $60 billion worth of losses. It was also one of the triggers for the global crypto winter. (Read more: Newsletter: What happened to USDT, UST, and LUNA)

In June, Justin Sun’s Tron DAO, USDD, also stumbled and depegged. Currently, it is trading below a dollar at $0.9741110, as per the data from CoinGecko. (Read more: Justin Sun’s Stablecoin USDD is Showing Signs of Depegging)

“Stablecoins were comparatively resilient in the second half, despite periodic fears of another depegging event,” CoinGecko noted.

3. Bitcoin performed the worst, compared to major assets

“Major assets performed poorly across the board and ended with yearly price returns in the red, except for crude oil and the US Dollar Index (DXY), which saw a 6.4% and 8.0% gain, respectively. Among these assets, Bitcoin (BTC) recorded the steepest decline of 64.2%, which was almost twice that of NASDAQ (-34%) and at least thrice of S&P 500 (-20%).”

“Major assets performed poorly across the board and ended with yearly price returns in the red, except for crude oil and the US Dollar Index (DXY), which saw a 6.4% and 8.0% gain, respectively. Among these assets, Bitcoin (BTC) recorded the steepest decline of 64.2%, which was almost twice that of NASDAQ (-34%) and at least thrice of S&P 500 (-20%).”

Last Saturday, January 25, Bitcoin went back to the 20,000 mark as it closed at $20,961.34, a 5% increase from the previous day. In November 2021, BTC reached its all-time high value that exceeded over $65,000. (Read more: Crypto and BTC Price Update: Bulls Defend Bitcoin Above $20,000)

According to Coin ATM Radar, the installation of BTC and crypto ATMs also slowed down in 2022. (Read more: Crypto Winter Halts Growth in Crypto ATM Installations – 2022 Data)

On April 1, 2022, BTC reached a total of 19 million minted token milestones, leaving two million Bitcoins to mint until the maximum supply set of 21 million. (Read more: Bitcoin Hits 19 Million Milestone; Only 2 Million Left to Mine)

4. Ether staking saw steady quarterly growth, driven by Ethereum upgrades

Thanks to their upgrades, Ethereum was able to navigate through the crypto bear market. According to CoinGecko, staked ether (ETH) grew steadily quarter-on-quarter (QoQ) throughout 2022.

“Total number of staked ETH reached 15.8 million by year-end, up from 8.8 million. Following Ethereum’s successful Merge in mid-September, total staked ETH posted notable growth of 12.5% in Q4. This indicates that bear market sentiments were outweighed by anticipation for Ethereum’s Shanghai upgrade, which will allow staking withdrawals and is slated for March 2023,” CoinGecko highlighted.

“Total number of staked ETH reached 15.8 million by year-end, up from 8.8 million. Following Ethereum’s successful Merge in mid-September, total staked ETH posted notable growth of 12.5% in Q4. This indicates that bear market sentiments were outweighed by anticipation for Ethereum’s Shanghai upgrade, which will allow staking withdrawals and is slated for March 2023,” CoinGecko highlighted.

In mid-2022, Ethereum launched Merge, their mainnet’s Mainnet transition from proof-of-work (PoW) to fully proof-of-stake (PoS) consensus mechanism to reduce Ethereum’s energy consumption by 99.95% which can lessen the carbon footprint of the blockchain. (Read more: What is the Ethereum Merge?)

This year, the blockchain is gearing up for the public test of Ethereum Shanghai, a key software upgrade that will allow users to withdraw staked $ETH from the Beacon Chain starting in December 2020. The testnet is set to happen in the first quarter of 2023. (Read more: Liquid Staking Protocols Experience Token Price Increase Amid Ethereum Shanghai)

5. DeFi sector still reeling from major setbacks

“The market capitalization of DeFi tokens plummeted by 72.9% year-on-year (YoY) to $17.9 billion, the lowest in two years… Lending protocols (-80.5%) and yield aggregators (-85.3%) were the worst-performing verticals for the year, due to inflated valuations and capital withdrawals,” the report stressed.

“The market capitalization of DeFi tokens plummeted by 72.9% year-on-year (YoY) to $17.9 billion, the lowest in two years… Lending protocols (-80.5%) and yield aggregators (-85.3%) were the worst-performing verticals for the year, due to inflated valuations and capital withdrawals,” the report stressed.

The collapse of Terra is cited as wiping out billions across the DeFi ecosystem, while the FTX collapse that happened last November led to a further decline of 24.4% QoQ. (Read more: What Happened? BlockFi Files for Bankruptcy Amid FTX Crypto Contagion)

Sam Bankman-Fried, the founder and former CEO of FTX, is currently in the US to face his charges. On January 3, 2023, he pleaded not guilty through his lawyer to eight different counts of charges, including wire fraud and campaign finance violations. (Read more: FTX Founder Pleads Not Guilty, Trial to Start in October)

6. Amid first NFT winter, OpenSea defends leading position

Despite the ongoing crypto winter, NFT marketplaces are still stable, CoinGecko noted, adding that the top five NFT marketplaces’ trading volume plunged sharply by 93.2% in December.

Despite the ongoing crypto winter, NFT marketplaces are still stable, CoinGecko noted, adding that the top five NFT marketplaces’ trading volume plunged sharply by 93.2% in December.

The report also highlighted that OpenSea continued to dominate with a market share of 65.4% as of year-end. However, during the 3rd quarter of 2022, according to a study by Binance Market Pulse, the marketplace briefly almost lost its dominance as it had fierce competition from two other Ethereum-based marketplaces X2Y2 and Looksrare, as well as its closest competitor Magic Eden. (Read more: NFT Sales Slumps in Q3 2022 as OpenSea Dominance Fades)

On the other hand, the NFT creator royalties shrank by a significant 94.9%, reaching to as low as $16 million in December, CoinGecko stressed.

7. Spot trading declined to all-year lows in December

“Spot trading volume across the top 10 cryptocurrency exchanges reached $1.5 trillion in January but sank 67.3% to an all-year low of $0.46 trillion in December. The dwindling volumes point to crypto investors distancing themselves from the market, or exiting it entirely. As at the year end, centralized exchanges commanded 92.5% of trading volume,” CoinGecko noted in a statement.

“Spot trading volume across the top 10 cryptocurrency exchanges reached $1.5 trillion in January but sank 67.3% to an all-year low of $0.46 trillion in December. The dwindling volumes point to crypto investors distancing themselves from the market, or exiting it entirely. As at the year end, centralized exchanges commanded 92.5% of trading volume,” CoinGecko noted in a statement.

Spot trading is the regular buying and selling (trading) of cryptocurrencies and/or fiat on an exchange platform. (Read more: Spot Trading vs Holding: What’s the Difference?)

This article is published on BitPinas: CoinGecko’s 2022 Annual Crypto Industry Report: Crypto Market Lost At Least 50% of Value

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.