BSP Bans 6 Entities for Operating as Unregistered MSBs

The Monetary Board disqualifies six entities from registering as Money Service Businesses with the BSP due to operating illegally.

- Six entities have been disqualified by the Monetary Board (MB) from registering with the BSP for operating as Money Service Businesses (MSBs) without proper registration.

- The MB’s decision also extends to any sole proprietorship controlled by the owners/operators of these entities, preventing them from obtaining a license or engaging in authorized activities supervised by the BSP.

- This action is in line with the BSP’s efforts to address the proliferation of unauthorized MSBs, as stated in their media release and in accordance with Section 901-N of the Manual of Regulations for Non-Bank Financial Institutions.

In a media release, the Monetary Board (MB), policy making body of the Bangko Sentral ng Pilipinas (BSP), announced that it disqualified six entities from registering with the central bank for operating as a Money Service Businesses (MSBs) without registration. Money Exchange Services.

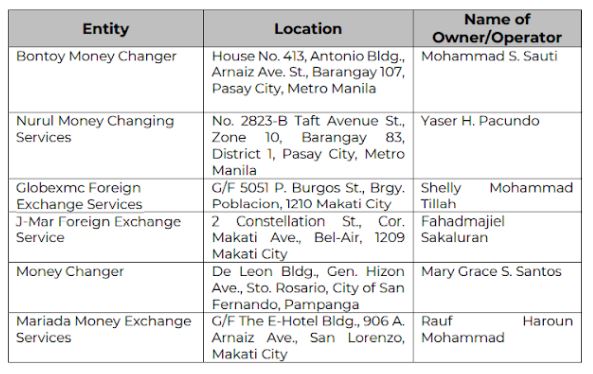

The Disqualified Entities

The firms are identified as Bontoy Money Changer, Nurul Money Changing Services, Globexmc Foreign Exchange Services, J-Mar Foreign Exchange Service, Money Changer, and Mariada Money Exchange.

The MB has prohibited any sole proprietorship that is owned and/or controlled by the owners/operators of the mentioned entities from registering or obtaining a license from the central bank. This also applies to engaging in any activity authorized or supervised by the BSP, specifically for operating as an MSB without prior registration.

(Read more: BSP: E-Wallets Now Contribute 40% of Retail Transactions)

“The above disqualification is pursuant to Section 901-N of the Manual of Regulations for Non-Bank Financial Institutions, and is part of BSP’s efforts to address the proliferation of entities engaged in the operation of unauthorized MSBs,” the BSP wrote in a statement.

BSP Recent News

According to the central bank, digital payments account now for over 40% of the total volume of retail transactions. In 2021, digital payments accounted for 30.3% of the volume, experiencing a substantial rise from 20.1% in the previous year.

Last May, the BSP warned the public that using Sangla-ATM, an informal lending system, can lead to financial difficulties for cardholders. According to the BSP, borrowers will have a hard time monitoring withdrawals made by others with access to the card and PIN, and creditors may also withdraw amounts exceeding the cardholders’ debt.

(Read more: BSP Advisory: Avoid Sangla-ATM Scheme)

In April, the central bank disclosed that overseas Filipino remittances have hit their lowest level since June 2022. Data shows a decline in both personal and cash remittances, reflecting the difficult economic circumstances experienced by Filipino workers overseas.

This article is published on BitPinas: BSP Bans 6 Entities for Operating as Unregistered MSBs

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.

![[Update] MiTrade and OctaFX Blocked: NTC Implements SEC Directive To Block Unlicensed Platforms 7 [Update] MiTrade and OctaFX Blocked: NTC Implements SEC Directive To Block Unlicensed Platforms](https://bitpinas.com/wp-content/uploads/2023/08/BitPinas-Banner-768x403.png)