GCash Muna Inaanak Ha! BSP Recommends Giving Digital Cash Gifts ‘E-Aguinaldo’ for Holiday Season

The BSP is encouraging Filipinos to give digital cash gifts this holiday season through interbank fund transfers and QRPh.

Subscribe to our newsletter!

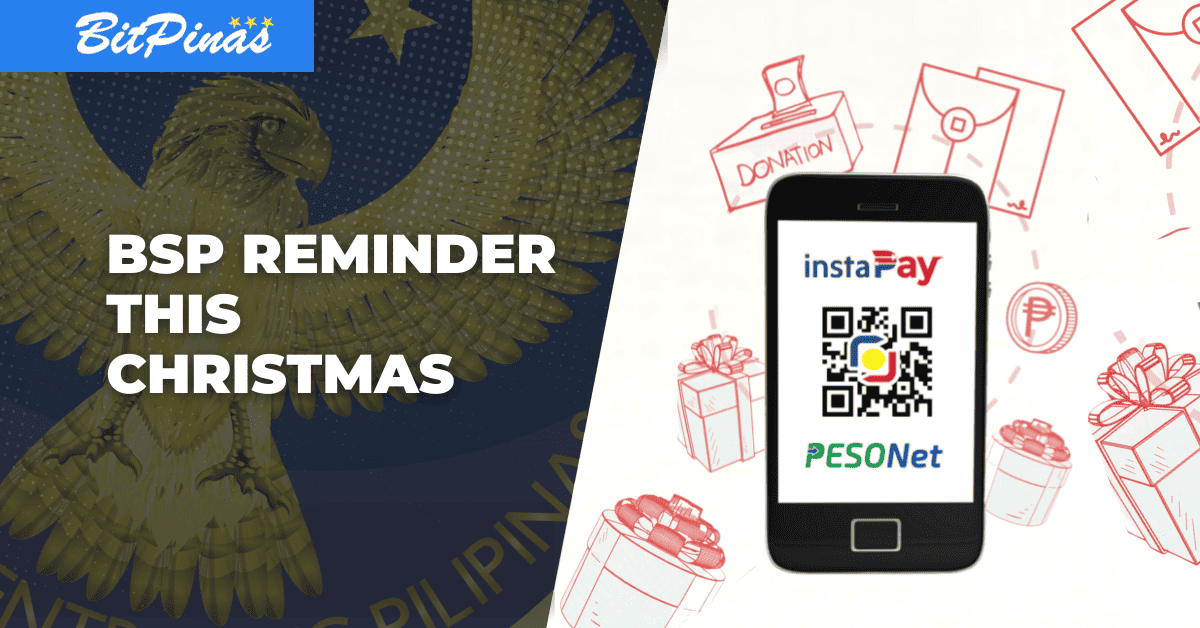

- The Bangko Sentral ng Pilipinas (BSP) is encouraging Filipinos to give digital cash gifts this holiday season through interbank fund transfers, electronic money issuers, and QRPh.

- Digital cash gifts, also known as electronic money, are stored digitally in an electronic account and can be accessed remotely through a device such as a mobile phone or prepaid card.

- The BSP’s push for digital cash gifts is part of its broader efforts to promote the wider adoption of digital payments and financial inclusion in the Philippines through its Digital Payments Transformation Roadmap, which aims to convert at least half of all retail payments into digital form and to onboard at least 70% of Filipino adults to the financial system by 2023.

“We encourage our countrymen to take advantage of the ease and safety provided by digital finance when sending their cash gifts during the holidays.”

This is the advertisement of the Bangko Sentral ng Pilipinas (BSP) as it highlights the advantages of giving digital cash gifts this holiday season.

“Ninongs, ninangs, and other gift-givers who intend to give cash as pamasko, as well as Filipinos who want to donate to charitable institutions, can transmit money conveniently through a wide array of digital payment channels available in the country,” the monetary authority explained.

According to the Central Bank, gift givers can consider giving digital cash gifts through interbank fund transfers through InstaPay and PESONet, electronic money issuers that are more commonly known as e-wallets, and QRPh, “which entails code scanning and offers consumers faster, easier, and cheaper payment options.”

What the BSP is mentioning about digital cash gifts is electronic money, a money whose monetary value is digitally stored in an electronic account. It can be accessed remotely via a device like a mobile phone or prepaid card. It can be transferred through:

- Interbank fund transfers through InstaPay and PESONet, the country’s first Automated Clearing House (ACH) under the National Retail Payment System (NRPS). Through these two electronic fund transfer services, bank customers can transfer funds in Philippine Peso to another account holder of the same bank, other participating banks, e-money issuers, and mobile money operators in the Philippines.

- Electronic money issuers or e-wallets. EMI license allows an operator of an application (like a mobile app), to convert cash in fiat to electronic peso. As of April, there are 29 Bank and 42 non-bank EMI license holders, which include Alipay, Cebuana Lhuillier, Coins.ph, Easypay, Gcash, GrabPay, Maya, Paymongo, PDAX, ShopeePay, USSC, and others.

- QR Ph, the Philippines’ QR code standard based on the Europay-Mastercard-VISA (EMV).

Read our quick guide about e-money and the EMI license at:

“The giving of e-aguinaldo supports the BSP’s broader thrust to foster the wider adoption of digital payments, which promotes financial inclusion and the efficient flow of funds in the economy,” the Central Bank emphasized.

Earlier this month, the country’s regulatory agency partnered with the Philippine Payments Management Inc. (PPMI) to launch the “Bills Pay PH” initiative, which aims to give consumers more options to pay their bills, and paying dues may be performed by scanning or uploading the QR Ph person-to-biller (P2B) code.

“The BSP pursues this under its Digital Payments Transformation Roadmap, which aims to convert at least half of the total volume of retail payments into digital form and to onboard at least 70 percent of Filipino adults to the financial system through transaction account ownership by 2023,” the BSP concluded.

This article is published on BitPinas: GCash Muna Inaanak Ha! BSP Recommends Giving Digital Cash Gifts ‘E-Aguinaldo’ for Holiday Season

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.