Digital Bank GoTyme Aims for 1M Customers This Month

GoTyme Bank, a digital banking joint venture between Gokongwei Group and Tyme, nears one million customers with fast onboarding and unique kiosk services.

- Digital bank GoTyme, a joint venture between Gokongwei Group and Tyme, is nearing one million customers, expected to be achieved in August.

- The bank attributes its success to fast customer onboarding, supported by the strong reputation and trust associated with the Gokongwei brand.

- GoTyme’s human-centric “phygital” model aims to offer a preferred banking experience to a broader customer base beyond the top 5 percent of the country.

Digital bank GoTyme, a joint venture between the Gokongwei Group and Singapore-based Tyme, announced that it is about to reach one million customers. As per the bank, the milestone is expected to be achieved this August.

Fast onboarding

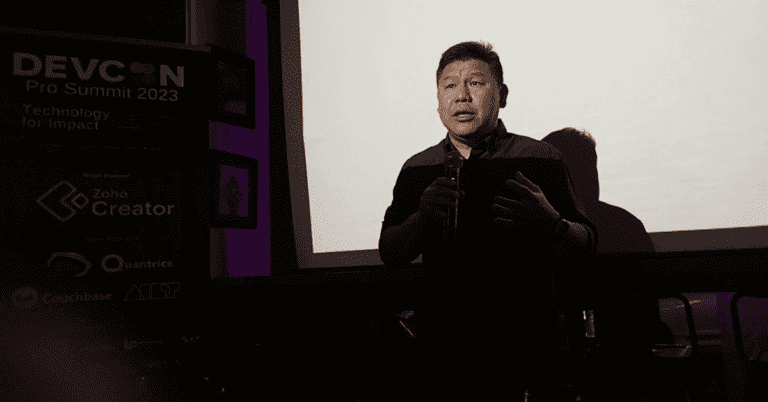

In an interview with ABS-CBN’s Market Edge, GoTyme president and CEO Nate Clarke attributed the bank’s success, especially on the fast onboarding of customers, to the Gokongwei brand’s strong reputation and customer loyalty.

(Read more: CIMB Bank’s Popular 12% Interest Rate Promo Extended)

“The second thing driving our success today is the trust of the Gokongwei Group. I think if you strip away all of the apps and the branches and everything else from banking in general, it’s a trust game, and the Gokongwei Group and the Gokongwei name is accelerating customer adoption on our side,” he stated.

In addition, Clarke highlighted their human-centric “phygital” model for digital banking, which he stated aims to provide a preferred banking experience to a broader customer base beyond the top 5 percent of the country.

GoTyme, citing its prior experience in South Africa, emphasized that it will be able to leverage Tyme’s existing products. GoTyme further stated that customers will soon see that its pace of product development will surpass those of other digital banks in the country.

“We’re not new to digital banking and we’ve done it at scale with 7 million customers in South Africa… GoTyme may be one of the newbies in digital banking in the country, but its experience in digital banking goes beyond the expertise of its employees and into that of its shareholders,” Clarke stated.

(Read more: SeaBank Philippines Announces Interest Rate Drop to 4.5%)

Future Plans

To date, GoTyme Bank currently operates over 300 kiosks in the Philippines and aims to increase this number to 450 by the end of 2023. These kiosks offer a one-of-a-kind service as it can collect personal information and issue a free Visa debit card in five minutes–unlike with traditional banks which usually take five business days.

“Our view is that digital banks are very well-placed, and GoTyme positions itself here, where we are more convenient than an e-wallet, and we are as safe or even safer than a traditional bank… We offer customers instant account opening and a free debit card at kiosks staffed by bank ambassadors across Robinsons retail locations nationwide,” Clarke stated.

Accordingly, with the upcoming merger between the Robinson’s Bank and BPI, though he can’t disclose anything yet Clarke expressed that they hope that GoTyme will also experience further expansion as their kiosks are only limited to Gokongwei establishments.

Moreover, he stated that the company will soon launch products to meet customer needs for credit, investments, and insurance.

(Read more: PH Digital Bank Tonik Reaches 1 Million Users Milestone)

What are digital banks? GoTyme?

GoTyme received its license in August 2021, and is the fifth applicant to be granted by the central bank a go signal. TThe digital bank got its Certificate of Authority (CA), the third and final stage in establishing a digital bank in the country, on July 29, 2022.

“Digital bank is our license type, but in the eyes of the customers and how we see ourselves, we are simply a bank. The way we deliver service is more digital focused than the traditional banks,” Clark said.

According to the Bangko Sentral ng Pilipinas (BSP), digital banks are a new category of banks that are separate from traditional banks. They provide banking services online, without the need for physical branches.

The Philippines currently has six licensed digital banks: GoTyme, Overseas Filipino Bank; Tonik Bank; UNObank; UnionDigital; and Maya Bank. The submission of applications for new digital banks will be closed until December 2024.

This article is published on BitPinas: Digital bank GoTyme aims for 1M Customers This Month

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.