BSP Makes it Easier to Report Problems with Locally-Licensed Crypto Exchanges

BSP said any customer can report local VASPs to the central if the company fails to address their concerns.

Subscribe to our newsletter!

- The BSP is encouraging Filipinos to report any issues with licensed Virtual Asset Service Providers (VASPs) directly to the central bank, as well as welcome inquiries and concerns regarding VASPs.

- Customers can reach the BSP Online Buddy or BOB if their BSP-licensed VASPs fail to address their concerns, through the BSP website, Facebook Messenger, or by sending a text message through 21582277 for Globe users.

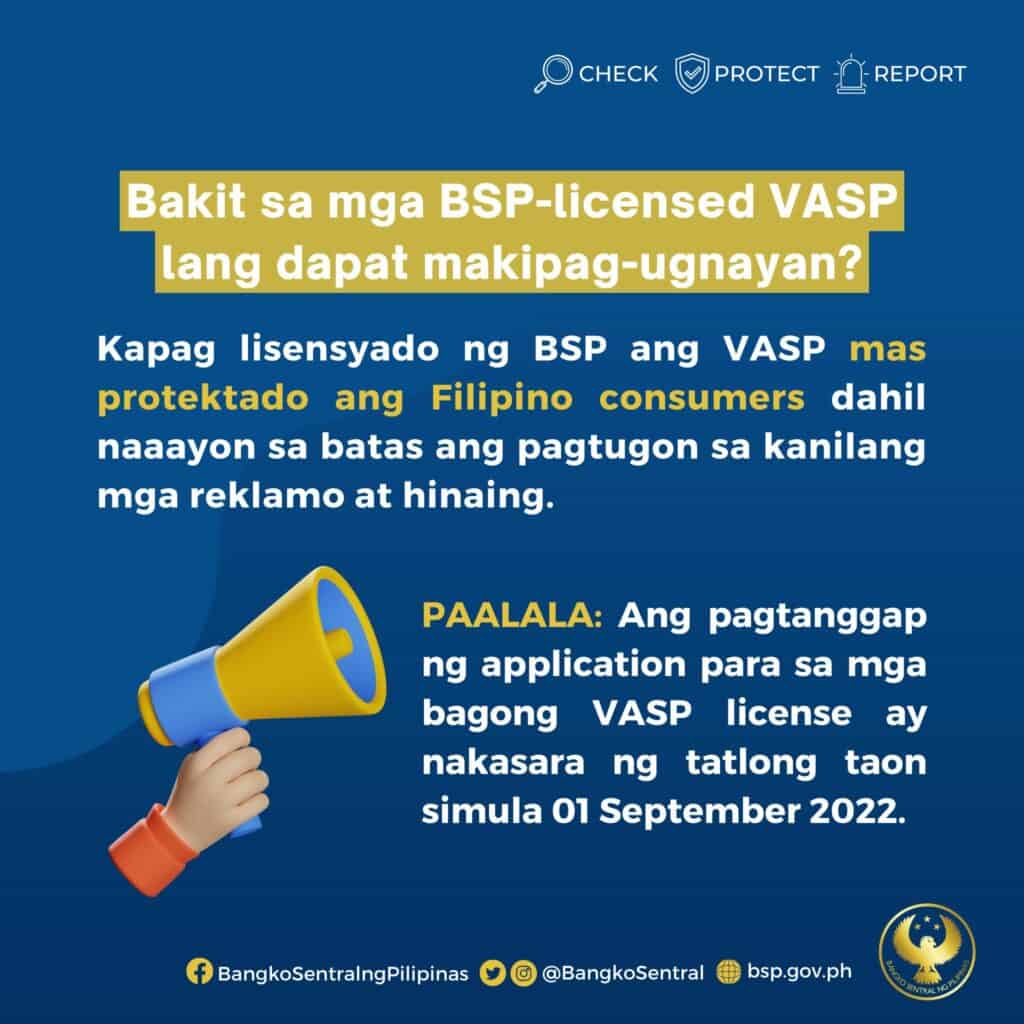

- As of January 31, 2023, there are 20 VASPs licensed and regulated by the BSP, and VASPs are entities that facilitate exchange between virtual assets and fiat currencies, exchange between virtual assets, transfer of virtual assets, and custody of these assets.

To cater with the increasing adoption and involvement of Filipinos with Virtual Asset Service Providers (VASPs), the Bangko Sentral ng Pilipinas (BSP) recently announced that users can report problems concerning their licensed providers directly to the central bank; questions and concerns are also welcomed.

In a Facebook post, the central bank stated that if their BSP-licensed VASPs failed to address the concerns, customers can contact them through their BSP Online Buddy or BOB.

Users can access BOB in three ways:

1. Click the BOB icon in the BSP Website.

2. Through Facebook Messenger.

3. For Globe users, they can send a text message through 21582277.

There are currently 20 VASPs licensed and regulated under the BSP.

- ABA Global Philippines, Inc. (under the trade name/s of COEX STAR)

- Appsolutely, Inc.

- Atomtrans Tech Corp.

- Betur Inc.

- Bexpress, Inc.

- Bloomsolutions, Inc

- Coinville Phils., Inc (Inactive status: stopped operations in October 2022)

- Direct Agent 5 (not yet operational)

- Etranss Remittance International Corp. (not operational)

- Frenetic, Inc.

- i-Remit, Inc. (not operational)

- Moneybees Forex Corp.

- Maya Philippines, Inc.

- Philbit Money Changer and Remittance Services, Inc.

- Philippine Digital Asset Exchange (PDAX)

- Rebittance, Inc. (not operational)

- TopJuan Technologies Corporation

- WIBS PHP, Inc. (not operational)

- XenRemit, Inc. (not yet operational)

- Zybi Tech, Inc. (Doing Business under the name and style of Juan Cash)

Last November, Meta’s digital wallet Novi was excluded in BSP’s list of registered VASPs. It was registered for 11 months as it received its license last September 2022. (Read more: Novi No Longer Included on BSP List of VASP Licensees)

October last year, the central bank granted universal bank UnionBank a limited virtual asset service provider (VASP) license while its application is still pending. (Read more: BSP Grants UnionBank with Limited VASP License)

What are VASPs?

Under the BSP Circular No. 1108 or the Guidelines for VASPs issued in January 2021, the BSP recognizes the evolving virtual asset systems or markets, and the risks associated with it because of its underlying features — anonymity, volatility of prices and “velocity” of transactions. The central bank considers VASPs as money service businesses, when fiat money is converted into virtual assets, and are still transferable and be used for payment.

Virtual Asset Service Providers are entities that facilitate exchange between virtual assets and fiat currencies, exchange between virtual assets, transfer of virtual assets, and custody of these assets. (Read more: Key Takeaways: Philippines Guidelines on Virtual Asset Service Providers – VASPs)

This article is published on BitPinas: BSP Makes it Easier to Report Problems with Locally-Licensed Crypto Exchanges

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.