Newsletter: What happened to USDT, UST, and LUNA | May 12, 2022

My simple explanation on what happened in the last few hours of UST, USDT, and LUNA.

(Feel free to forward this newsletter to your friends! And friends, if someone forwarded this to you, feel free to subscribe!)

“What’s happening?” Says 99% of Crypto Batch 2021.

What is happening to USDT?

The largest stablecoin by market cap – USDT or Tether – slipped to as low as $0.946 at cryptocurrency exchange FTX at around 3:10 pm Manila Time. As a stablecoin, USDT is supposed to maintain parity with the US dollar; It should always be 1 USDT = $1 most of the time with minor fluctuations.

According to Coindesk, traders are possibly selling USDT for actual US Dollars because of “poor sentiment for stablecoins” right now in the cryptocurrency space. Tether Inc (the company behind USDT) CTO Paolo Ardoino alleviated worries about USDT’s pegged value, reminding traders that the stablecoin can be redeemed back to US Dollar via their website https://tether.to. (Note: As I wrote this, USDT is back at $0.98-ish.)

This raises worries as to whether USDT itself is on the same path as UST. This leads us to our next segment:

What is UST?

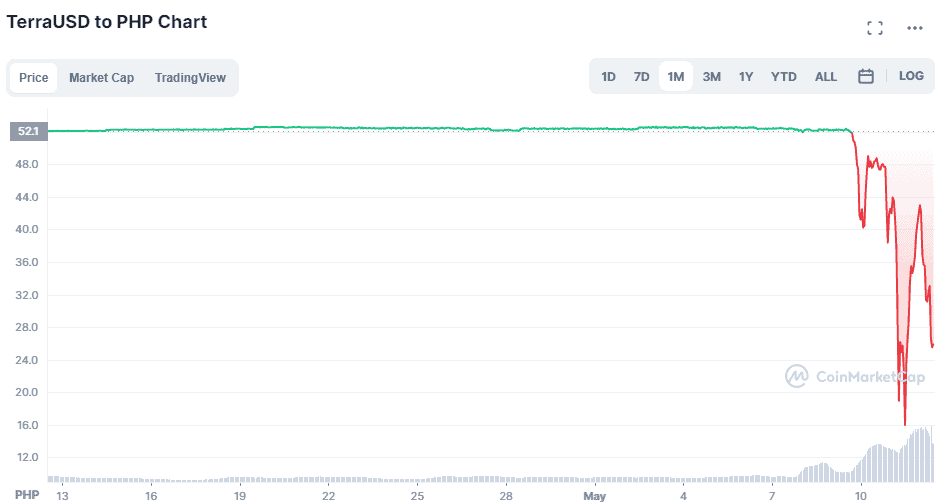

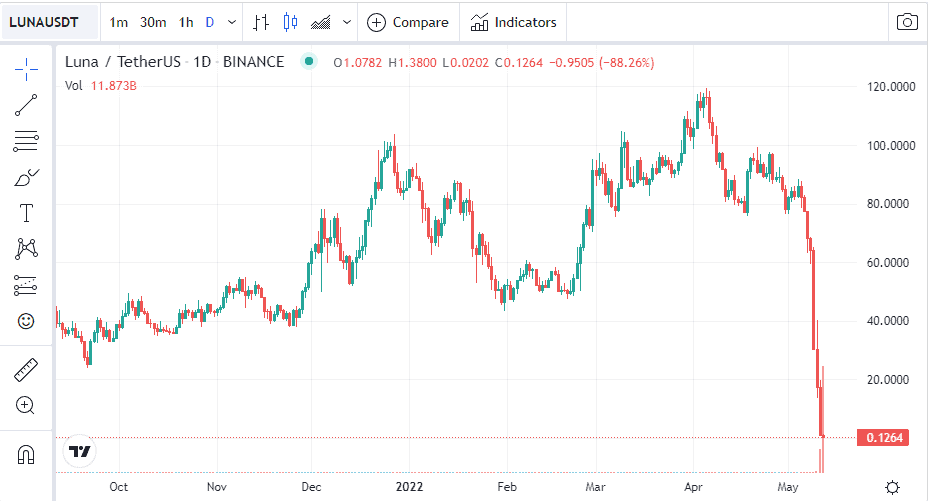

While USDT is backed by actual fiat reserves (although questionable) that can be redeemed, UST (TerraUSD) is an algorithmic stablecoin that keeps its value because of another token called LUNA, the main coin of the blockchain of the same name. For brevity’s sake, 1 UST is supposedly redeemable to $1 worth of LUNA. At one point, 1 LUNA was worth $119.

How does it work? Say UST drops to $0.98. This presents an opportunity to buy 1 UST for just $0.98, and then you trade that for $1 of LUNA. This is called arbitrage.

This in theory should put the price back to the peg of 1 UST = $1.

To sum up: To maintain the price of UST, the LUNA supply pool adds to or subtracts from UST’s supply. Users burn LUNA to mint UST and burn UST to mint LUNA. Of course the bigger the difference is, the better the arbitrage profit will be. This, along with the fact that LUNA should have a larger market cap than UST, should also avoid a situation wherein a lot of people are redeeming UST for LUNA.

To further prevent that from happening, Do Kwon, its founder, said they bought billions worth of Bitcoin (we will go back to this later) to make sure it has further money to deploy in case of unlikely scenarios of UST losing its peg.

But it happened.

Why did UST Lose Its Dollar Parity?

UST was not able to defend its peg and LUNA crashed too. It was a series of events but it’s possible that the major factor is clearly market uncertainty. With the market prices decreasing and as we appear to be heading to the bear market season, many people are clearly taking out their crypto for cold cash.

The other major thing is the Anchor Lending Protocol.

What is the Anchor Protocol?

In Anchor, people deposit their UST in order to reap 20% rewards. As per Coindesk, 75% of UST’s circulating supply is currently in Anchor and it was clear that many people buy UST just for the purpose of getting those sweet yields.

You know how these things usually go, when the yield rate starts decreasing, people will leave and go elsewhere. What happened here was that a lot of people started taking out their deposits to Anchor, which puts a huge selling pressure on both LUNA and UST.

At some point, it was no longer possible to redeem 1 UST for $1 worth of LUNA. This led to the deployment of the Bitcoin reserves to try to defend the peg. For a time UST appeared poised to go back to the peg but confidence in the project appears to be at an all-time low. UST is at $0.41 and LUNA, which was once worth $119 is now worth $0.07.

It’s important to remember that USDT and UST are different. USDT is fiat-backed (but admittedly there are some questions about that) while UST is an algorithmic stablecoin. I am seeing articles and tweets calling the US regulators to make sure to differentiate between stablecoins like USDT and algorithmic stablecoins like UST.

This deserves its own segment but ultimately, stablecoins, I think, must be able to prove themselves in times of stress or else the Financial Action Task Force will continue calling them “so-called stablecoins” because they are not really stable. (Of course fiat has that problem too, but this post is getting too long.)

This newsletter is published on BitPinas: Newsletter: What happened to USDT, UST, and LUNA | May 12, 2022

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.