Tuesday Trades: Too Much Volatility? Welcome to Crypto

Bitcoin hits $29,000. Coinbase sued over XRP Sale. Bitfinex CTO: Bitcoin dominance is inevitable.

Good morning. For those who have witnessed volatility for the first time, welcome to crypto. It’s a part of life here.

Welcome to Tuesday Trades, part of our new series: BitPinas Daily. We will look at the price of Bitcoin, Ethereum and the major cryptocurrencies. Crypto is global, but sometimes news that matters happens while we sleep. So we bring to you what’s happening in our space here and abroad.

Market Price as of January 5, 2021:

| Bitcoin | $31,516 | -4.62% |

| Ethereum | $1,025.65 | 5.67% |

| Tether | $0.99 | -0.3% |

| XRP | $0.23 | 4.55% |

| Litecoin | $152.07 | -4.69% |

| SLP | $0.018 | -1% |

Bitcoin closed January 4, 2021, at $31,516 per BTC. We’re up 20% in the last 7 days and 11% since the year began. This number is also 9% below the previous all-time high price of $34,684 that was hit on January 3, 2021.

Bitcoin’s market capitalization stands today at $603,840,346,341 which is 67.2% of the entire cryptocurrency market.

On the table above, there’s the cryptocurrency SLP. If you wonder what that is, check out this article: Playing Axie Infinity vs Minimum Basic Salary in the Philippines.

What crash?

Bloomberg: Bitcoin’s Rally Comes to a Halt as Prices Fall Most Since March

Bitcoin fizzled in Monday trading as the famously volatile cryptocurrency pulled back after a spectacular new-year rally.

Prices fell as much as 17% in the biggest drop since March before recovering. The losses are small in the context of Bitcoin’s broader rally, with a 50% jump in December alone. After a parabolic 2020, the digital currency had started the new year with a bang, surging as high as $34,000 and hitting all-time highs on Sunday. (Joanna Ossinger)

Bitfinex: Bitcoin Retracement is Unsurprising

Paolo Ardoino, CTO at Bitfinex said the retracement of Bitcoin is unsurprising yet may be short-lived.

“Today we’ve seen some profit taking. We are not making predictions, but this may be short-lived; based on the sentiment among traders on Bitfinex, we perceive that the overall bullish sentiment around Bitcoin hasn’t changed.”

Ardoino also said the prevalence of high frequency trading firms are there to mitigate such sharp falls. “Through their role as intermediaries, HFT’s thereby immediately provide buying pressure in response to such a sharp price drop. Having thick order books and healthy liquidity also helps.”

Banks

Coindesk: Crypto Markets Jump on OCC Approval for Banks to Use Blockchains

Cryptocurrency prices jumped Monday evening after the U.S. Office of the Comptroller of the Currency (OCC) issued a letter approving U.S. banks to use public blockchain networks. The letter addressed national banks and federal savings associations participating as nodes on a blockchain and storing or validating payments made in native digital assets or stablecoins.

The OCC’s letter stands in contrast to a bill introduced in the last Congressional session that would have required stablecoin issuers to obtain bank charters. (Zack Voell)

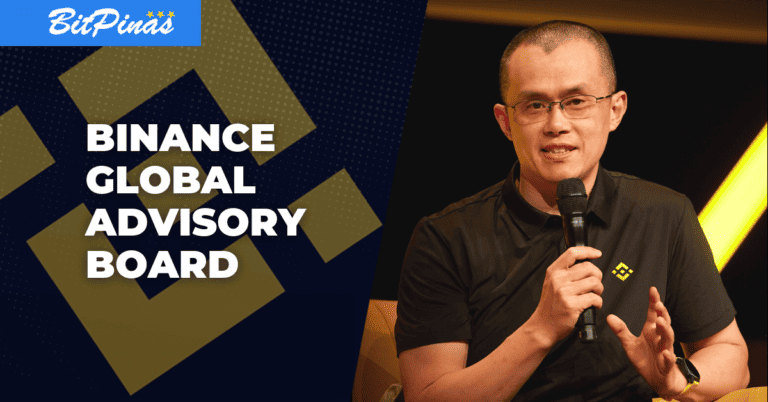

Binance

Cointelegraph: Binance hits record high of $80B in daily volume as crypto markets surge

Changpeng Zhao, the chief executive of Binance, the world’s largest crypto exchange by trade volume, reported a record of $80 billion in 24-hour trade activity on Jan. 4. On Twitter, CZ compared the recent activity to the volume posted during the last record-breaking bull cycle, noting that the past day of trade equates to four-time the volume processed on the exchange from Nov. 15, 2017 to Dec. 15, 2017. (Samuel Haig)

DeFi

Cointelegraph: ‘Insane’ ETH fees delay launch of Aavegotchi NFT game

Decentralized finance project Aavegotchi is pushing back the mainnet launch of its non-fungible token digital collectible game due to high activity on the Ethereum blockchain. According to a Tweet from its team today, Aavegotchi will be postponing the Jan. 4 launch of its game in response to the “insanely high gas costs” and “extreme volatility” on Ethereum. The project also stated it will “most likely” migrate to the Matic Network — a smart-contract platform and layer two scaling solution for Ethereum. (Turner Wright)

#CryptoPH

BlockchainSpace Discusses Axie Scholarships

Do you want to play Axie Infinity but don’t know where to start? Or maybe you don’t have the funds? Enter Axie Scholarships. In the Blockchain Space Axie Academy, they will provide you a loan of 3-Axie Teams, education on the game and SLP Farming, crypto education, community building and support.

Peter Ing, the head of Blockchain Space discussed the Axie Scholarship Model, why it is popular, and the value proposal of these types of endeavors to increase play-to-earn and crypto adoption. (Blockchain Space)

What else is happening

- Open interest on Bitcoin derivatives reached an all-time high on Sunday (MK Manoylov, The Block)

- Square says new FinCEN wallet proposal will inhibit crypto adoption and hinder law enforcement efforts (Saniya Moore, The Block)

- DeFi Hits Historic $17.5 Billion Locked, But ETH Is Still Flowing Out (Alexander Behrens, Decrypt)

This article is published on BitPinas: Monday Trades: Too Much Volatility? Welcome to Crypto