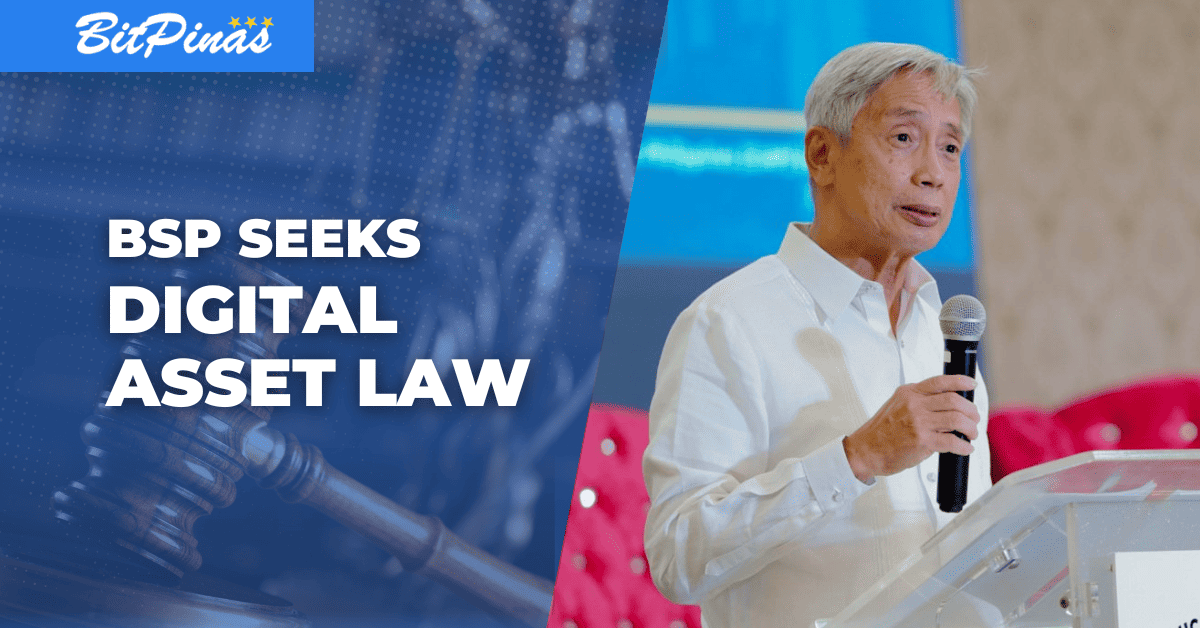

BSP Seeks Passage of Digital Asset Law

BSP seeks legislative proposals to regulate digital assets and clear rules defining what it can do.

In order to protect the consumers, the Bangko Sentral ng Pilipinas (BSP) wants to draw lines on the regulations on digital assets and the digital space— this includes non-fungible tokens (NFT) and cryptocurrencies.

The concern of the central bank, along with the Securities and Exchange Commission (SEC), was addressed during a meeting with the Senate Committee on Banks, Financial Institutions and Currencies. The gathering was attended FintechAlliance.Ph, Binance, Cagayan Economic Zone Authority (CEZA), BSP and SEC to discuss the Senate Bill 184 or the Digital Assets Act and Senate Resolution 126 on cryptocurrencies and other digital assets.

The Digital Assets Act only aims to recognize but not regulate digital assets by defining what digital assets are and standardizing the process for the licensing and operation of e-money, virtual asset exchanges, and virtual asset businesses.

According to the BSP, what they seek are legislative proposals to regulate digital assets and clear rules defining what it can do to protect owners of virtual assets and customers of virtual asset service providers (VASPS).

Virtual Asset Service Providers (VASP) are entities that facilitate exchange between virtual asset and fiat currencies, virtual asset to virtual asset, custody or transfer of virtual assets.

Currently, the central bank can only utilize circulars and follow guidelines to impose protection for the consumers. Moreover, the BSP also has no power over foreign VASPs that offer services to Filipinos. The central bank also noted that it does not have clear rules on NFTs, NFT marketplaces, and decentralized finance (DeFi) like cryptocurrency lending.

With the current widespread adoption of cryptocurrency and its affiliates in the country, the BSP wants to address the said loopholes and push for laws to regulate digital assets and other acts of identity theft such as phishing and social engineering schemes. The central bank also specifically mentioned passing the Financial Accounts Regulation Act which features the criminalization of the sale of financial accounts for use as “money mule”.

Accordingly, Lito Villanueva, the Fintech Alliance Chairman, also expressed their support to the Digital Assets Act as their alliance also prioritizes “putting consumer protection at the core.”

“We look forward to having risk-based regulations without stifling innovations for inclusion. There must be more clarity on the rules of engagement for emerging technologies such as non-fungible tokens or NFTs, NFT marketplaces, decentralized finance, and exchange-traded funds or EFTs, among others,” he stated.

While the BSP and SEC are pushing for regulation, Chairman of the Ways and Means CommitteeRep. Joey Salceda pushes for taxation as he recently refiled the Digital Economy Value Added Tax (VAT) Law in the 19th Congress. He also expressed his plans to create a group that would study the possibility of taxing digital assets. (Read more: Solon Will Form Working Group to Study NFT, Crypto Taxes)

Recently, the BSP issued an advisory to the public that “strongly urges” them not to deal with VASPs that are unregistered with the central bank or domiciled abroad. According to the central bank, foreign-based VASPs may present additional challenges in enforcing legal recourse and consumer protection and redress mechanisms for local customers. (Read more: BSP Cautions the Public Against Engaging with Unregistered and Foreign Virtual Asset Service Providers (VASPs))

Prior to the advisory, Deputy Governor Chuchi Fonacier signed a memorandum imposing a ban on VASP license applications for the next 3 years starting on September 1st. (Read more: BSP Imposes Ban on VASP License Application)

While BSP Governor Felipe Medalla priorly said that he is not keen on regulating cryptocurrency and referring it to the “greater fool’s theory”, he reiterated that he also does not look into banning it. However, the central bank head questioned “what social good” Bitcoin achieve when it’s used to evade the government. (Read more: BSP Governor: No Plans to Ban Crypto But What Social Good Does It Achieve?)

On the other hand, the BSP’s central bank digital currency (CBDC) –digital currency centralized, issued, and regulated by a central bank– is set to have its pilot testing at the last quarter of this year. (Read more: BSP CBDC Digital Currency Initiative Scheduled for Q4 2022)

This article is published on BitPinas: BSP Seeks Passage of Digital Asset Law

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.