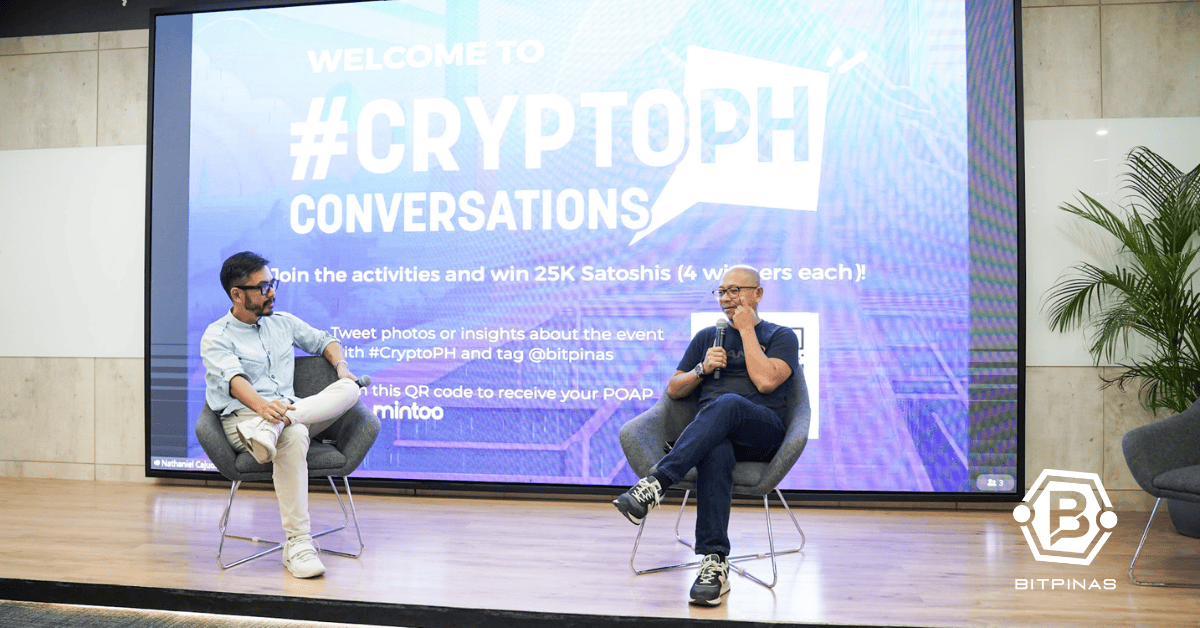

Ex-Solgen Hilbay, GCash Exec Luis Buenaventura Discuss Bitcoin in Recent #CryptoPH Conversations Meetup

From Bitcoin Halving to ETFs, to Bitcoin as money as property, the two crypto thought leaders — Luis Buenaventura and Florin Hilbay — gave insights on the future of crypto in the recent CryptoPH Conversations meetup.

By Nathaniel Cajuday and Michael Mislos

When Florin Hilbay first proposed teaching a Bitcoin course at Silliman University, he anticipated skepticism. Although the historic educational institution in Dumaguete ultimately approved his plans, Hilbay first thought their agreement might have been just a courteous gesture.

“In the beginning I thought they were just being nice to me, that perhaps ‘Florin is suffering a midlife crisis’. Some perhaps thought ‘he’s done some good for the Republic, let’s just give him a pass’.”

Florin Hilbay, Dean of the College of Law at Silliman University

You cannot be unkind or ungrateful to Florin Hilbay. As the former Solicitor General of the Philippines, he vigorously defended the country’s territorial rights in the international case concerning the West Philippine Sea; a detailed recap of which is beyond the scope of this crypto news website.

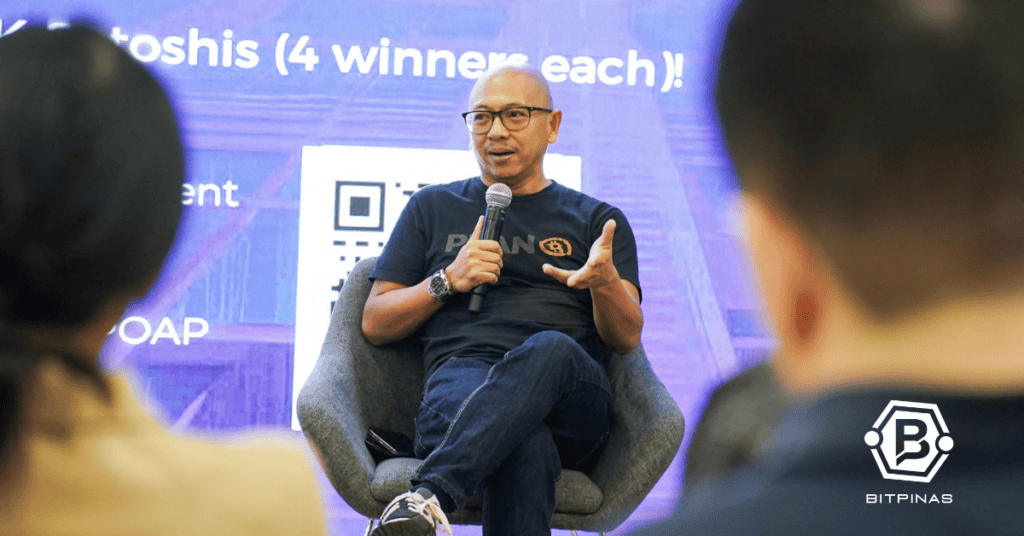

Still, at the recent #CryptoPH Conversations meetup, organized by BitPinas and GCash executive Luis Buenaventura and supported by Bitshares Labs held at the GCash office, Hilbay was answering and educating the attendees about Bitcoin—a topic and philosophy he plans to advocate for the rest of his life, at least that’s what we thought while listening to him during the meetup.

The discussions, held the day before the fourth Bitcoin Halving, covered topics ranging from the leading cryptocurrency to the nuances of Bitcoin exchange-traded funds (BTC ETFs) and more.

Table of Contents

Learning Curve: Florin Hilbay’s Journey with Bitcoin

Florin Hilbay recounted his initial reluctance towards Bitcoin in 2014 during his tenure as Solicitor General. His interest was piqued in 2017 by discussions with his brother about cryptocurrency and solidified in 2020 when global disruptions led him to reevaluate his understanding of money and justice.

“And so when I went to my brother and talked to him, ‘I think I’m interested in this thing.’ He started laughing and I haven’t stopped learning ever since. I must have read about 40 books on finance, economics, and history because the problem with Bitcoin, that’s why it’s so complex and complicated, is that it’s not only difficult to understand, you also have to unlearn so much.”

Florin Hilbay, Dean, Silliman University College of Law

Hilbay cited The Bullish Case for Bitcoin by Vijay Boyapati as influential in his Bitcoin education. The book, which began as a Medium article, offers a straightforward look at Bitcoin’s potential, stripped of polemics.

He admitted, however, that getting to learn about Bitcoin is “a very personal thing,” indicating the varied paths people might take based on their interests and backgrounds.

“The Bitcoin space is sufficiently diverse, so if you search wide enough you’ll be able to find the proper bitcoiner for your type of temperament regardless of age philosophy, or political views.”

Florin Hilbay, Dean, Silliman University College of Law

What Does Bitcoin Solve?

For Hilbay, Bitcoin has solved a very important problem of humanity – inflation and money printing.

“You are the first generation in the history of humanity that will live through that age where inflation has already been solved.”

Florin Hilbay, Dean, Silliman University College of Law

Hilbay expressed his belief in Bitcoin’s role beyond traditional asset classes. “Bitcoin is going after all real estate, stocks, bonds, and artwork,” he stated, envisioning a shift in how societal wealth is defined and stored.

Still, he acknowledged that Bitcoin’s biggest usecase is still as a new form of money:

“So if you want to call that money, you can call it money. If you want to call that property or asset, you can call it property or asset. But the moment we start looking at it from the old model—money is different from property, then you’ll have to make that distinction, but Bitcoin is so new that you have to destroy those old models ultimately.“

Florin Hilbay, Dean, Silliman University College of Law

The Role of Bitcoin ETFs

The format of #CryptoPH Conversations meetup is such that the attendees must ask a question to the speakers – so for this one, it’s to Hilbay and to GCash’ Exec Luis Buenaventura. The person who asks the question must select the person who will ask the next question.

More than the Bitcoin Halving (which Buenaventura gave a presentation of earlier in the meetup), the next biggest topic is the Bitcoin Spot ETFs.

Buenaventura first highlighted the fact that the first “victim” of Bitcoin ETF was actually Gold ETF; One of the first things observed was that about $3 billion worth of Gold ETFs were liquidated and that money flowed into Bitcoin ETFs.

“So it’s kind of interesting to see it happening in real time where people are already starting to reorient themselves, ‘Ah okay, maybe this is actually a better alternative to the gold ETFs.’”

Luis Buenaventura, Executive, GCash

But Bitcoin is supposed to be decentralized, and so, many in the community thought the ETF launch is just a return to the old ways, where the supposed “old guards” — the very institutions that Bitcoin sought to replace — are now in control of Bitcoin.

Addressing the nature of Bitcoin ETFs, Buenaventura clarified, “It’s not actually BlackRock that owns those bitcoins… it’s their customers.” This distinction highlights the indirect but significant influence of ETFs on Bitcoin’s integration into mainstream finance.

Hilbay said the ETFs are a good marketing strategy for Bitcoin:

“I think it’s good marketing for Bitcoin because Bitcoin will have to be financialized, meaning you’re creating an entirely new political and economic system over this thing—a decentralized political and economic order I can only envision.”

Florin Hilbay, Dean, Silliman University College of Law

The Theoretical Impact of Satoshi’s Identity Reveal

Speculating on the potential impact of Satoshi Nakamoto’s identity reveal, Hilbay emphasized that Bitcoin’s decentralized nature would persist regardless of its creator’s actions. “Bitcoin is now literally a force of nature,” he remarked.

Meanwhile, for Buenaventura, the only basis to know if someone is the real Satoshi Nakamoto is when they can open the wallet where the 1 million $BTC is stored.

“If he unlocks it, I guess the next thing he has to do is he has to decide whether he’s going to sell it or not.”

He then explained that he thinks the community is ready to see Satoshi, given the many people have already claimed (or people have thought) they are Satoshi:

“Actually, in a way, we already had a dress rehearsal for that because we’ve had multiple Satoshi over the last few years. So you’ve had Dorian Nakamoto and then you’ve also had Craig Wright. So we’ve had a couple of people who have claimed that they were Satoshi and both times the registered price there was a bit of a dip—there was some uncertainty.”

Luis Buenaventura, Executive, GCash

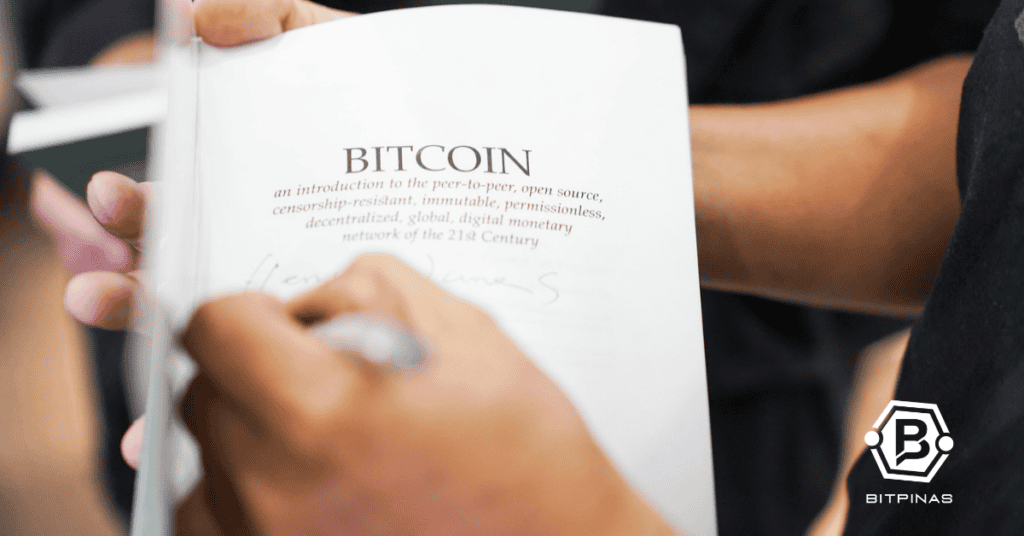

Teaching Bitcoin’s Significance

As mentioned at the beginning of the article, Hilbay is teaching a course on Bitcoin at Silliman University. While many are cautious at the beginning, he admitted that he and others who followed him since 2022 at the school are starting to look like geniuses because of how high the value of Bitcoin is now compared to when he started teaching.

“Before they didn’t want to study, but now they still don’t want to study it but want to buy, so that’s progress.”

Florin Hilbay, Dean, Silliman University College of Law

The BSP

Hilbay then expressed his gratitude to the Bangko Sentral ng Pilipinas (BSP) for implementing a regulation that allows Filipinos to buy, sell, and hodl cryptocurrencies.

“For example, every time I speak in public about Bitcoin and banking, a lot of people expect that I’ll go all out against central banks—no. In fact, I’m very thankful to the BSP because they have provided a favorable regulatory environment so that people can buy and hold, and that’s a good thing.”

“I wouldn’t be surprised if, within the next 10 to 20 years, you’ll have central banks, including the Philippine Central Bank, starting to realize we cannot kill this thing, and because this thing is so scarce, you might as well join it.”

Florin Hilbay, Dean, Silliman University College of Law

Thoughts on Bitcoin’s Role Amid Global Challenges

Finally, Buenaventura and Hilbay reflected on Bitcoin’s resilience and potential as a safe haven during global upheavals, suggesting its emerging role as a stabilizing asset in times of uncertainty.

“Money printing will be favorable to scarce assets and that will have to be very good for Bitcoin. The only thing that you have right now is a gap between knowledge and your understanding of what Bitcoin is all about.”

Florin Hilbay, Dean, Silliman University College of Law

This article is published on BitPinas: Ex-Solgen Hilbay, GCash Exec Luis Buenaventura Discuss Bitcoin in Recent #CryptoPH Conversations Meetup

Disclaimer:

- Before investing in any cryptocurrency, it is essential that you carry out your own due diligence and seek appropriate professional advice about your specific position before making any financial decisions.

- BitPinas provides content for informational purposes only and does not constitute investment advice. Your actions are solely your own responsibility. This website is not responsible for any losses you may incur, nor will it claim attribution for your gains.

![[After Long Silence] Binance Assures PH Users Following SEC Demand; Google, Apple Urged to Hear All Sides 3 [After Long Silence] Binance Assures PH Users Following SEC Demand; Google, Apple Urged to Hear All Sides](https://bitpinas.com/wp-content/uploads/2023/08/BitPinas-Banner-768x403.png)