Luis Buenaventura II: Proof-of-Work (PoW) vs. Proof-of-Stake (PoS)

Today’s #crypto briefing won’t be about the news then since there isn’t much (unless you’re interested in the Pentagon’s UFO announcement). As promised, we’re going to compare Proof-of-Work ($BTC, $ETH) vs Proof-of-Stake ($ADA, $ETH2, etc) blockchains.

This article was written on the morning of May 24, 2021.

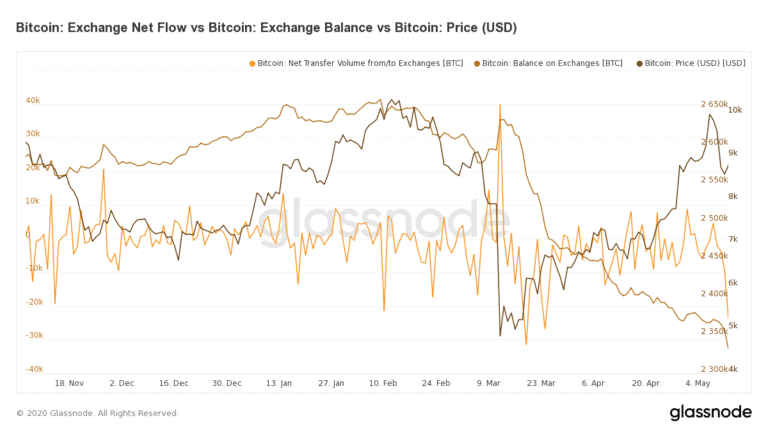

Good morning, cryptofam! China’s Friday evening announcement of “crypto mining crackdowns” is continuing to apply downward pressure on the markets today, with $BTC and $ETH hovering just above $35k and $2k respectively.

It’s important to remember that weekend trading is very much a “retail customer” affair — none of the institutional traders are at the office. This means that it tends to be influenced by either hype or FUD to a much greater degree, hence the continuing selloff.

Today’s #crypto briefing won’t be about the news then since there isn’t much (unless you’re interested in the Pentagon’s UFO announcement). As promised, we’re going to compare Proof-of-Work ($BTC, $ETH) vs Proof-of-Stake ($ADA, $ETH2, etc) blockchains.

How Blockchains Work

If you don’t know what those words mean, here’s a quick refresher: blockchains work by maintaining thousands of copies of itself across thousands of participants. Now if you have that many live copies, you need to make sure that they are all in agreement on which version is the correct one. That agreement is what we call “consensus,” and PoW and PoS are examples of “consensus mechanisms,” i.e., how a blockchain decides which copy is correct. We rely on consensus to determine everything from BTC transactions to NFT minting to DEX trades; it’s at the very heart of every blockchain.

The first thing you have to understand about the PoW vs PoS debate is that it’s been going on forever. The first coin to use the PoS mechanism — Peercoin — is only three years younger than Bitcoin, so it’s not a terribly new idea. Ethereum 2 will be the largest and most high-profile implementation to date, when it launches.

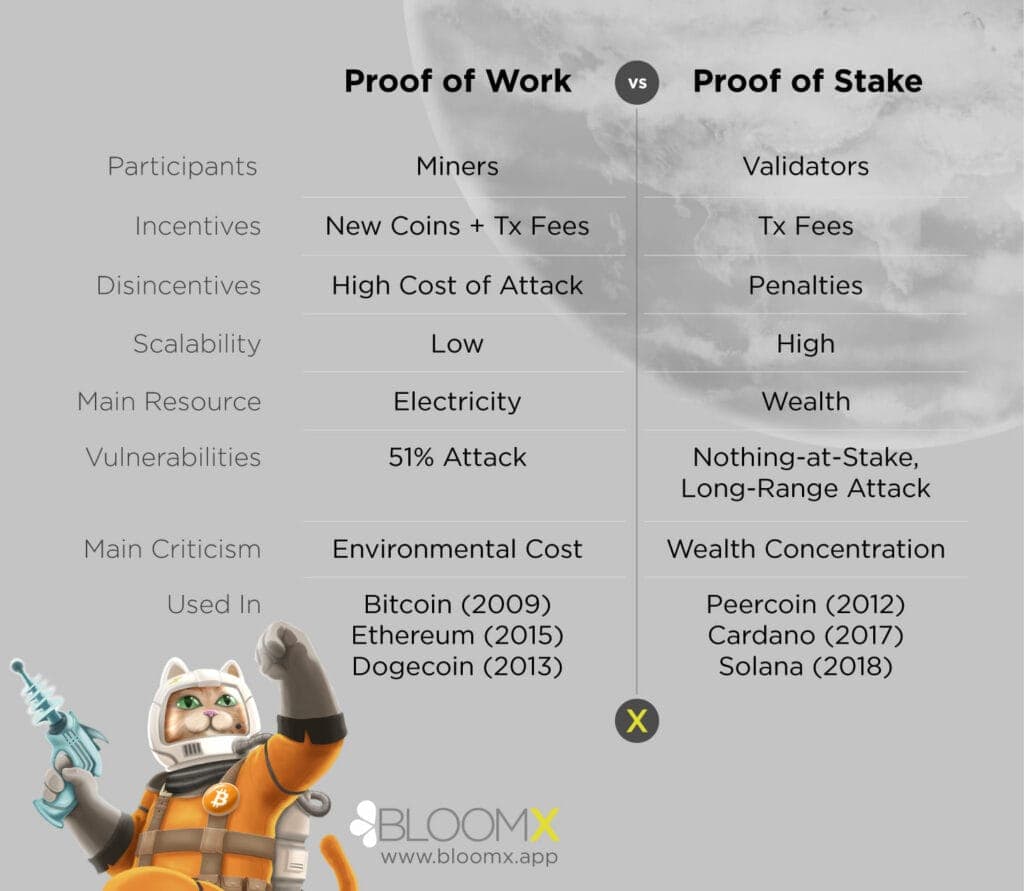

As a companion to this post, I created a simple infographic that lists down some of the differences between PoW and PoS, so please check that out in the photos, and feel free to share it on your own FB groups. I’m not going to write about each of those differences here, but instead I will zero in on two parts of the debate that I find to be the most critical.

Is PoS less secure than PoW?

Because PoS is often marketed as a replacement for PoW, we need to ask if it’s at least as secure as the thing it’s replacing. What do we mean by “secure” here? Essentially we are talking about how resistant it is to attacks both external and internal.

Unfortunately, the answer to that question depends greatly on how much you value decentralization. To illustrate, here’s a key situation that highlights the difference between PoW and PoS:

What happens when a new participant comes onboard the network? In PoW, it’s straightforward. The new participant just looks up what the longest copy of the blockchain is (literally by counting the number of blocks on it), and KNOWS that that is the correct copy. This is because PoW determines correctness by the length of the chain. A longer chain means that more work was put into it (hence the “proof of work” moniker), therefore it is the correct one. PoW’s energy-intensive nature makes it very costly to make a fake copy that has more blocks on it. In Bitcoin, at least, it’s extremely improbable.

On PoS systems, however, a new user has to CHOOSE which copy to believe, and then base all their subsequent transactions on that copy. They can’t just count the number of blocks, because unlike in PoW, there’s no cost to creating blocks in a PoS blockchain. It’s therefore possible for malicious participants to create an infinite number of divergent copies of the chain in an attempt to swing transactions in their favor. This is referred to as the “Weak Subjectivity” problem.

The technical way to contrast these two onboarding methods is that PoW is trustless and objective, while PoS requires *some* trust and is therefore subjective.

Now, in most cases, this is totally benign and not at all malicious: if a new ETH2 participant joins the network, they can look up the copy being broadcasted by the Ethereum Foundation or Consensys, and rest assured that that is correct. But therein lies your decentralization problem. If Ethereum Foundation was ever attacked from within, the whole thing crumbles. And perhaps more “big picture,” if we’re all just basing our ledgers on whatever Ethereum Foundation says, then we’re just building Paypal again, aren’t we?

This is not an impossible problem, however, there is ALWAYS a security tradeoff. For example, ETH2 uses “checkpoints” in the life of its chain as a way to solve for this: (https://notes.ethereum.org/@adiasg/weak-subjectvity-eth2), which is like a “guaranteed” correct copy up to a recent moment in the past. This lessens the impact of weak subjectivity by reducing the size of the questionable dataset to just the last few blocks, but it does not fully solve the problem.

So is PoS more secure than PoW? Not in the ideal decentralized sense, but if you’re willing to rely on friendly third parties, it’s probably good. Only time will tell if it’s good ENOUGH.

Does PoS make the rich richer?

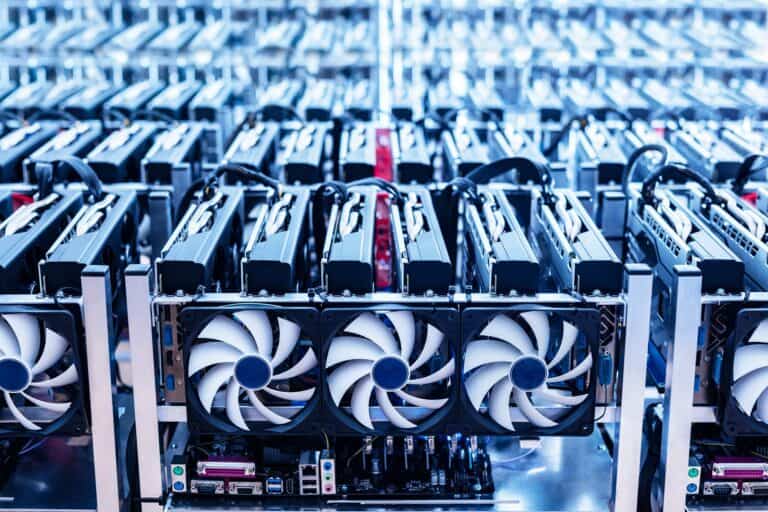

Let’s look at the primary resources used by PoW and PoS. In PoW, miners buy machines that consume lots and lots of electricity to protect the blockchain. PoW is basically a race to find the cheapest electricity in the world, which is why you see a lot of it happening in China, where there’s a surplus of electricity, and conversely, none in Africa, because there’s a deficit there. It’s easy to describe the total cost of PoW as the capital cost of the machines + the ongoing cost of electricity.

In PoS, the cost is opaque, because the primary resource is the cryptocurrency itself. The way PoS works is that participants deposit some amount of their crypto (their “stake”) for a chance to earn transaction fees. The idea here is that a participant in a network probably cares about the network in direct proportion to the size of their stake in it. We often refer to this as “skin in the game,” and it usually works.

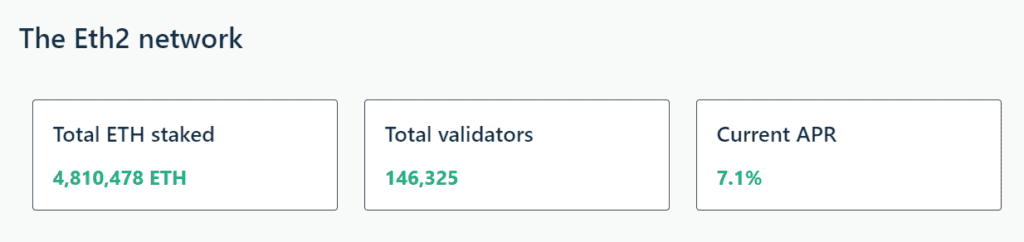

Let’s say that the total amount of staked ETH was 1,000,000, and your personal stake was 10,000 ETH. You have a 1% chance of being awarded the transaction fees for every block. The current estimates for ETH2 is 7% annualized returns on your staked coins, although of course this number decreases as more stakers join up. (https://launchpad.ethereum.org/en/)

Now if every participant in the network was staking 10,000 ETH then everything would be totally fine; it’s a completely fair system where 100 people each have a 1% chance to earn transaction fees. But of course in practice that’s impossible. There is a high probability that 80% of the staked ETH will belong to just 20% of the participants, in a well-known economic phenomenon known as the Pareto Principle.

Why is that bad though? Well, if this wealthy minority has a combined 80% chance of winning the lottery, then an unhealthy cycle emerges. They could continue to plow their earnings back into the network and increase their stake even more, which would increase their chances of winning the lottery even more, and so on, ad infinitum. (EOS creator Dan Larimer describes the problem in more detail here: https://bytemaster.medium.com/decentralizing-in-spite-of-pareto-principle-eda86bb8228b

That being said, the same “rich getting richer” argument is also true for PoW, at least in the sense that you also need substantial capital to make it work. However, the Bitcoin mining industry is a lot more entrepreneurial, as there’s plenty of innovation in that space that’s coming up with clever ways to make it more sustainable (see companies like UpstreamData.com for example).

With PoS systems, meanwhile, you basically only need to be rich to get ahead.

TLDR; Is PoS Better than PoW?

Inevitably someone is going to ask me which of these (PoW or PoS) I prefer, and I’m not going to cop out on my answer. I think that, with PoW, Satoshi came up with an elegant solution to an impossible problem, and eleven years later it appears to be our best available consensus mechanism that has a chance of being truly decentralized.

I don’t believe that’s currently the case with PoS. I’m aware of charts indicating that ETH2 staking is currently looking a lot more decentralized than the 80/20 Pareto scenario I described above, but (1) ETH2 isn’t transactionally operational yet, and (2) the reason why it’s called Pareto *Principle* is because systems trend towards that ratio even when participants are aware of it.

After all is said and done, it may very well be the case that the only way to reduce the energy consumption of PoW is to replace it with that all-too-human resource called “trust” via PoS. That’s not necessarily a bad thing, and I expect that many people will be perfectly willing to make that tradeoff.

Additional Reading:

- https://blog.ethereum.org/2014/11/25/proof-stake-learned-love-weak-subjectivity/

- https://vitalik.ca/general/2020/11/06/pos2020.html

- https://medium.com/@BobMcElrath/whats-wrong-with-proof-of-stake-77d4f370be15

- https://medium.com/@abhisharm/understanding-proof-of-stake-through-its-flaws-part-2-nothing-s-at-stake-8d12d826956c

This article is published originally as a Facebook post and republished with permission on BitPinas: Luis Buenaventura II: Proof-of-Work (PoW) vs. Proof-of-Stake (PoS)