For Pinoy Freelancers: Cross-Border Payment Startup Parallax Secures $4.5M

Alongside the announcement is the startup’s introduction of its new service that allows its users to convert U.S. dollars into local currencies.

- A Filipino-led startup that aims to provide fast and cheap international payments for freelancers has secured $4.5 million investment during its recently concluded seed funding round led by Dragonfly Capital.

- The startup said that the funding raised will be used to continue to grow its team and scale its operations.

- It introduced its new in-app feature, where its users will now have the ability to convert U.S. dollars into local currencies.

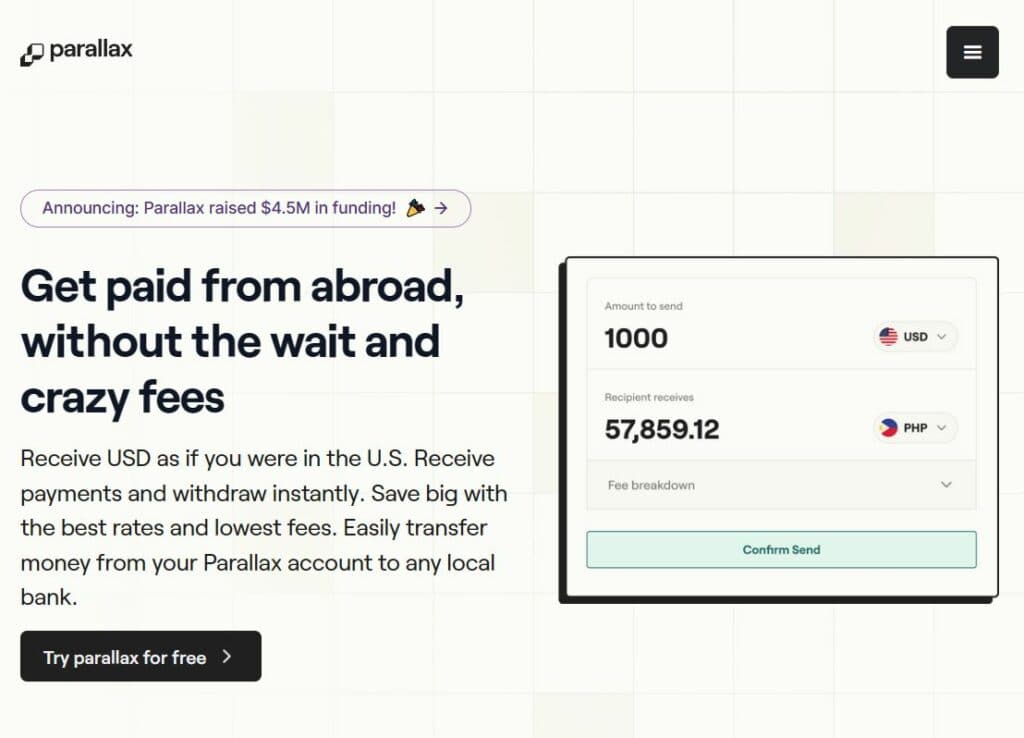

Parallax, a Filipino-led startup that aims to provide fast and cheap international payments for freelancers, announced that it has raised $4.5 million worth of investments in its recently concluded seed funding round led by Dragonfly Capital, a global investment fund that focuses on supporting crypto and fintech projects.

Alongside the announcement is the startup’s introduction of its new service that allows its users to convert U.S. dollars into local currencies.

Check out more fintech news:

Parallax’s Seed Funding Round

In a statement, the startup said that the funding raised will be used to continue to grow its team and scale its operations.

The fundraising was also joined by Circle Ventures (the issuer of $USDC), General Catalyst, gumi Cryptos Capital, Palm Drive Capital, Comma Capital, Firsthand Alliance, and some key players from the fintech industry, including Zach Abrams, the former Coinbase head of product.

Parallax’s New Product

Accordingly, Parallax introduced its new in-app feature, where its users will now have the ability to convert U.S. dollars into local currencies. It is now available to select users worldwide, as per the startup.

“For example, in the Philippines, users can cash out their USD into their local bank accounts like BPI, UnionBank, BDO and more, or e-wallets like GCash or Paymaya, and have the pesos arrive in minutes,” Parallax CEO Mika Reyes said.

The startup’s initial product only allows users outside the U.S. to open a USD Virtual Account to receive dollar with just their passport. The newly introduced product then enables users to convert the U.S. dollar they receive to local currency, like the Philippine peso.

“The product is comparable to Paypal, Payoneer and Wise, and differentiates on providing faster and lesser fee transactions as we leverage modern technologies,” Reyes added.

What is Parallax?

Parallax claims to provide faster and 83% cheaper international payments.

“We’re focused on providing freelancers, remote workers and other global professionals better payments for their recurring payroll, invoices and salaries,” Reyes stressed.

Moreover, she cited the challenge to send money abroad because it includes high frees and slow process. This makes Parallax aim to offer a “fast, affordable, and simple global payment experience,” as per the CEO.

Reyes also introduced herself as a freelancer, content creator, and an immigrant who experienced these challenges:

“I wanted to solve my problem and help my friends, as well as Filipinos from my home and many others from developing markets get paid their hard-earned money in affordable, fast and reliable ways.”

Meanwhile, Parallax Co-Founder Alex Kuang expressed his interest to utilize modern technology to boost financial transactions around the globe.

“We were collaborating closely with contractors and freelancers who wanted and preferred to get paid in stablecoins given the speed and affordability,” Kuang concluded. “But the barrier for mass adoption is in making the technology accessible and more user-friendly. We found this gap to be a massive opportunity.”

This article is published on BitPinas: For Pinoy Freelancers: Cross-Border Payment Startup Parallax Secures $4.5M

Disclaimer:

- Before investing in any cryptocurrency, it is essential that you carry out your own due diligence and seek appropriate professional advice about your specific position before making any financial decisions.

- BitPinas provides content for informational purposes only and does not constitute investment advice. Your actions are solely your own responsibility. This website is not responsible for any losses you may incur, nor will it claim attribution for your gains.