Don’t Pay to Borrow: SEC Warns About Advance Fee Scam

SEC issues a warning on the ‘Advance Fee Scam,’ advising the public to stay alert to fake loan offers requiring upfront payments.

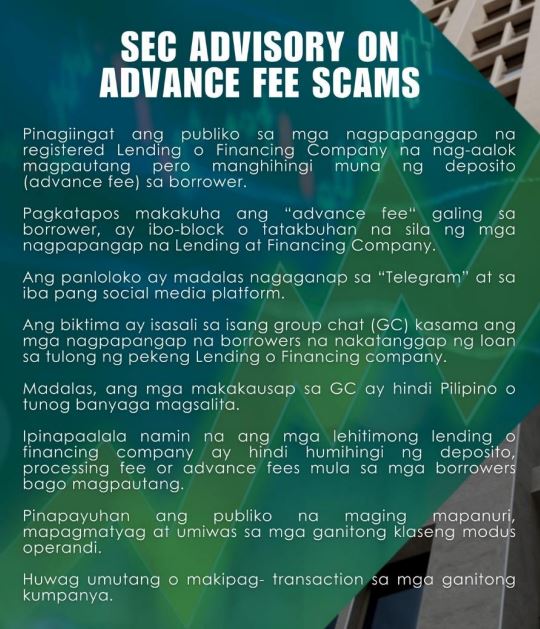

- SEC warns of “Advance Fee Scam,” cautioning the public against impostors posing as legitimate lending or financing companies requiring upfront deposits.

- The scam involves deceiving victims with promises of benefits or financial gains in exchange for upfront payments, often occurring on platforms like “Telegram” and social media.

- The public is reminded to verify the legitimacy of financial transactions and stay vigilant against potential scams.

The Securities and Exchange Commission (SEC) warned about a new scam known as the “Advance Fee Scam”. The public is reminded to be cautious against impostors pretending to be registered lending or financing companies offering loans but requiring a deposit or an advance fee from the borrower first.

Table of Contents

What is the Advance Fee Scam?

According to the Commission, the “advance fee scam” is a form of deception wherein individuals or entities, frequently masquerading as legitimate service providers, lenders, or organizations, solicit an upfront payment or fee from the victim, promising a greater benefit, service, or financial gain in the future.

How does advance fee scam happen?

The SEC noted that perpetrators may falsely claim to offer loans and ask potential borrowers to pay an upfront fee or deposit before the loan is processed or granted.

Once the victim pays the advance fee, the scammer typically disappears without providing the promised loan or service.

The Commission shared that the deception frequently occurs on “Telegram” and other social media platforms. Victims are added to a group chat with fake borrowers who claim to have received a loan with the help of a fake lending or financing company.

In addition, the SEC noted that the individuals in the group chat often speak in a non-Filipino or foreign-sounding language.

Red Flags to Watch Out For

Upfront Payments

Genuine lenders do not request upfront payments, deposits, processing fees, or advance fees prior to offering loans. Exercise caution if you encounter a demand for a substantial payment before receiving any services.

Unrealistic Promises

Scammers often make promises that seem too good to be true, such as guaranteed approval for a loan, regardless of credit history. Borrowers must be cautious if the offer appears overly generous or unrealistic.

Pressure Tactics

Fraudsters might employ high-pressure strategies to push individuals into quick decision-making, this could also . Be cautious of urgency in requests for payment or personal information.

Anonymous or Unverified Platforms

If transactions or communication take place on anonymous or unverified platforms, such as private messaging apps or social media, it could raise concerns. Legitimate businesses usually operate on established and verifiable platforms.

Lack of Official Documentation

Legitimate lending or financing transactions involve proper documentation and contracts. Investors must make sure that they are dealing with registered firms. If the process lacks transparency or official paperwork, it may indicate a scam.

Unprofessional Communication

Poor grammar, spelling mistakes, or communication that appears unprofessional can be indicative of a scam. Usage of other languages could also be a red flag. Legitimate businesses maintain a professional standard in their interactions.

Foreign or Untraceable Contacts

Scammers may operate from foreign locations or use untraceable contact information. Be cautious if it is challenging to verify the legitimacy of the company or individual.

No Physical Address

Legitimate businesses typically have a physical address. If the lender or financing company does not provide a verifiable physical location, it could be a red flag.

Unsolicited Offers

If you receive unsolicited loan offers through emails, messages, or calls, be cautious. Legitimate lenders do not usually reach out randomly to offer loans.

SEC Reminders and Advisories

Legitimate lending or financing companies do not request deposits, processing fees, or advance fees from borrowers before providing loans.

The Commission emphasized individuals should carefully research any financial transaction involving an advance fee, as it often indicates a potential scam. Moreover, the public is urged to stay vigilant, be observant, and avoid involvement with such schemes.

Last month, the SEC cautioned the public about “recharging and tasking scam,” where fraudsters employ fake e-commerce platforms, pretending to be reputable companies like Amazon and Shopee, luring individuals to invest with promises of commissions and rewards. The scheme, resembling a Ponzi scheme, uses new investors’ funds to pay fake profits to earlier investors despite the promised rewards.

This article is published on BitPinas: SEC Issues Public Warning on Advance Fee Scam

Disclaimer:

- Before investing in any cryptocurrency, it is essential that you carry out your own due diligence and seek appropriate professional advice about your specific position before making any financial decisions.

- BitPinas provides content for informational purposes only and does not constitute investment advice. Your actions are solely your own responsibility. This website is not responsible for any losses you may incur, nor will it claim attribution for your gains.

![[After Long Silence] Binance Assures PH Users Following SEC Demand; Google, Apple Urged to Hear All Sides 2 [After Long Silence] Binance Assures PH Users Following SEC Demand; Google, Apple Urged to Hear All Sides](https://bitpinas.com/wp-content/uploads/2023/08/BitPinas-Banner-768x403.png)

![[JUST IN] PH SEC Weighs Options, Evaluates Impact of Binance Ban 10 [JUST IN] PH SEC Weighs Options, Evaluates Impact of Binance Ban](https://bitpinas.com/wp-content/uploads/2024/02/PH-SEC-Weighs-Options-Evaluates-Impact-of-Binance-Ban-768x402.png)