Ethena Airdrop and Protocol Guide

Ethena Airdrop redeeming of ENA tokens will begin on April 2. Find out the details here.

Updated on March 29, 2024 (View the updated content here)

Stablecoins are cryptocurrencies whose values are pegged to an asset, either gold, fiat money like U.S. dollars, or even other tokens.

We already know that it is among the most used cryptocurrencies in the industry. Some use stablecoins for sending money without using traditional remittance platforms, some transfer their assets into stablecoins to play safe from the market’s volatility, and some even use stablecoins for paying gas fees and other transaction fees.

However, stablecoin issuers rely heavily on traditional financial institutions, as every stablecoin normally is represented by an asset reserve on these centralized institutions.

There is a DeFi protocol that believes that decentralized stablecoins need decentralized financial institutions to enable a “truly decentralized financial system.”

Read more: 30+ Potential Crypto Airdrops to Watch Out For in 2024

H/T to Paolo Dioquino of DeFi Philippines BitPinas provides content for informational purposes only and does not constitute investment advice. Your actions are solely your own responsibility. This website is not responsible for any losses you may incur, nor will it claim attribution for your gains.

Table of Contents

Ethena Introduction

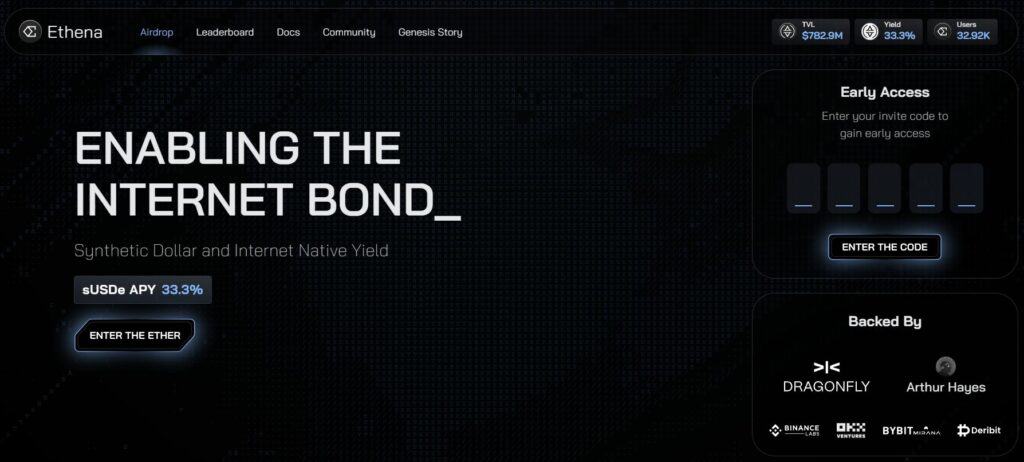

Ethena (https://www.ethena.fi/) is an Ethereum-based synthetic dollar protocol that is seeking to provide a crypto-native solution for money not reliant on traditional banking system infrastructure.

According to the protocol, “overcollateralized stablecoins” are experiencing scalability issues as their growth was inexorably tied to the on-chain growth in leverage demand for Ethereum.

“Lately, some stablecoins have resorted to onboarding Treasuries in an effort to improve scalability, at the cost of censorship resistance,” the team explained.

Ethena $USDe

Ethena then introduced $USDe, a synthetic dollar that aims to provide the first censorship-resistant, scalable, and stable crypto-native solution for money achieved by delta-hedging staked Ethereum collateral.

“Through the use of derivatives on staked Ethereum collateral on deep and liquid centralized venues, USDe aims to directly address both the scalability ‘stablecoin trilemma’ that previous decentralized stablecoins designs have encountered, as well as the custodial risk deficiencies of centralized stablecoins,” the team added. The stablecoin trilemma that it mentions refers to issues relating to scalability, mechanism design, and a lack of embedded yield.

$USDe will be fully backed transparently on-chain and free to compose throughout DeFi, while its peg stability is ensured through the use of delta hedging derivatives positions against protocol-held collateral, as per the Etherea developers.

Moreover, aside from its synthetic dollar product, Ethena is also set to offer a “globally accessible dollar-denominated savings instrument” called the Internet Bond.

It is designed to combine yield derived from staked $ETH as well as the funding and basis spread from perpetual and futures markets, to create the first on-chain crypto-native “bond” that can function as a dollar-denominated savings instrument for users in permitted jurisdictions, the team clarified:

“By focusing on staked Ethereum—the only collateral asset that can provide an uncensorable and trustless native yield at scale—the Ethena protocol addresses all of the aforementioned issues while providing users access to fully custodial and backed stability with an embedded yield inherent to the protocol system. Most importantly, doing so without a dependence on the existing banking system.”

In traditional finance, a bond is a debt security that represents a loan made by an investor to a borrower, usually a corporation or a government. The borrower should pay back the principal amount of the loan at a specified maturity date, as well as interest payments at a fixed or variable rate.

In the Philippines, the Philippine Bureau of Treasury (BTr) issues treasury bonds, which are fixed-interest government securities with a set maturity period. They play a crucial role in funding the executive department’s projects and programs.

Read: Philippines Introduces Blockchain Tokenized Treasury Bonds via PDAX

Ethena Airdrop Guide

Updated Ethena Airdrop to Commence

Ethena ENA Token Airdrop Announcement

- The Shard Campaign will officially end on April 1st; users must not unstake, unlock, or sell their USDe before this date to be eligible for the ENA token airdrop.

- Eligible users can claim their ENA tokens starting April 2nd, coinciding with the token’s listing on various Centralized Exchanges (CEXs).

- A vesting period applies to large wallet holders, with a 50% linear vesting over six months.

- Any unclaimed or unvested tokens due to early exits by users will be reallocated to loyal participants within the Ethena ecosystem.

- A second season of incentives is set to commence immediately on April 2nd, with enhanced loyalty rewards for users continuing their engagement from the first season.

How to Claim ENA Airdrop

- Claiming ENA tokens is available for 30 days post-launch, after which unclaimed tokens will be redistributed to active users within the second season of incentives.

- Ethena emphasizes that redistributed unclaimed tokens will benefit users, not core contributors or the Foundation.

- Over the past six weeks, users have accumulated “shards” reflecting their contribution to the ecosystem, which will determine the distribution of 750 million ENA tokens (5% of total supply) on April 2nd.

- Claims for ENA tokens can be made at claim.ethena.fi starting April 2nd; the site will become accessible a day prior to claims opening.

- The official Ethena website (app.ethena.fi) and its “Claim” tab is the recommended route for users to avoid fraudulent third-party links.

Old content follows:

How to Join Ethena Airdrop:

- Step 1: Go to https://app.ethena.fi/join.

- Step 2: Connect a wallet. Recommended wallets include MetMask, Binance Web3 Wallet, WalletConnect, Rabby Wallet, and OKX Wallet.

- Step 3: To earn shards, do the activities listed:

- Provide liquidity and lock LP tokens (20x Shards per day)

- Hold USDe YT or LP on Pendle (10x Shards per day)

- Lock USDe (10x Shards per day)

- Buy and hold USDe (5x Shards per day)

- Stake and hold USDe (1x Shards per day)

- Invite people to Ethena (+10% Shards per invite)

Take note that the Shards Campaign also follows a leaderboard system, but it is not yet clear if the number of rewards depends on the ranking.

This article is published on BitPinas: Ethena Airdrop and Protocol Guide

Disclaimer:

- Before investing in any cryptocurrency, it is essential that you carry out your own due diligence and seek appropriate professional advice about your specific position before making any financial decisions.

- BitPinas provides content for informational purposes only and does not constitute investment advice. Your actions are solely your own responsibility. This website is not responsible for any losses you may incur, nor will it claim attribution for your gains.