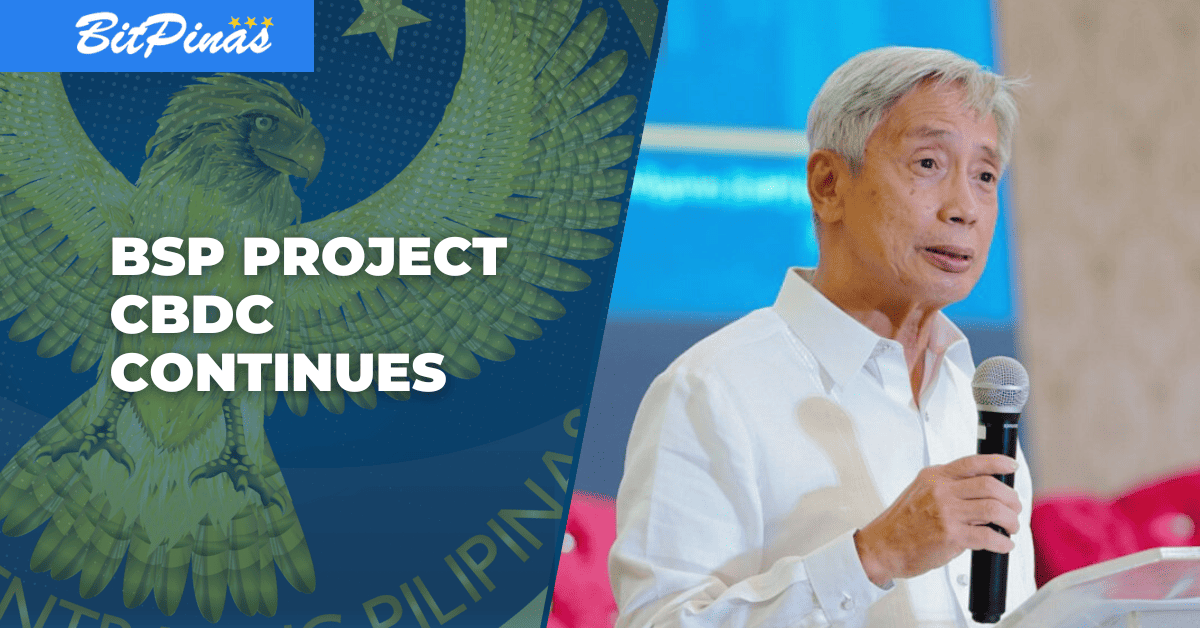

For Wholesale Transactions Only: BSP Confirms Continuation of Pilot Test of Country’s Own Central Bank Digital Currency

According to BSP Gov. Medalla, Project CBDH aims to allow any Southeast Asian native in the country to make wholesale transactions.

Subscribe to our newsletter!

Editing by Nathaniel Cajuday

- The BSP is continuing its pilot test of Central Bank Digital Currency (CBDC) between financial institutions, businesses, and government entities, BSP Governor Medalla confirmed.

- CBDC is part of the Central Bank’s initiative to shift 50% of all financial transactions to electronic channels.

- The eventual goal, according to Medalla, is to allow any residents in Southeast Asia to transact across the region using just their mobile phones.

The Bangko Sentral ng Pilipinas (BSP) has revealed that it is continuing the pilot run of its central bank digital currency project, called Project CBDCPH, for wholesale transactions, BSP Governor Felipe Medalla said in a statement, adding that the goal of the project is to eventually allow any residents of Southeast Asian countries to make payments in the country using their phones.

Central Bank Digital Currencies (CBDC) are digital forms of the country’s currency and are backed directly by BSP reserves. This is different from the e-money that Filipinos use daily when transacting online, which is backed by the person’s money in their e-wallets or mobile bank accounts. Because it is regulated by the central bank, the government can quickly intervene or implement monetary policies at the account level.

According to Medalla, the country’s monetary authority is not pursuing retail or general-purpose CBDC, which utilizes CBDC for the public’s use. Rather, it is focusing on wholesale CBDC, or transactions between financial institutions, businesses, and governments.

“We will not go into retail CBDC. We will be in wholesale CBDC, which hopefully, will also facilitate cross-border transfers,” the BSP Governor told the press.

Wholesale CBDC is expected to address frictions between institutional exchange and even cross-border money transfers.

“This is a pilot, not a full-blown implementation of CBDC,” former Governor Benjamin Diokno said in May of last year.

Diokno, who is now the country’s Finance Secretary, also said in a Senate hearing that he feels CBDCs are not yet a worthwhile undertaking in the Philippines, citing the BSP study conducted during his tenure as its Governor.

“The results of our study is that let’s focus on InstaPay and PESONet first before we go to CBDCs,” Diokno told the Senate, referring to the two payment rails – InstaPay and PESONet which allows account holders of different financial institutions, including licensed cryptocurrency exchanges, to send funds to other financial institutions.

Medalla did say that the BSP is planning to launch more initiatives to fully transition the Philippines from being a cash society to a “cash-lite economy.” This includes InstaPay Debit Pull and Request to Pay. This is also part of the central bank’s roadmap to increase the number of Filipinos with a bank account by 70% by 2023 and transition 50% of all transactions to be coursed via electronic channels within the same year.

Medalla’s tenure as Central Bank Governor ends in July 2023.

This article is published on BitPinas: For Wholesale Transactions Only: BSP Confirms Continuation of Pilot Test of Country’s Own Central Bank Digital Currency

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.