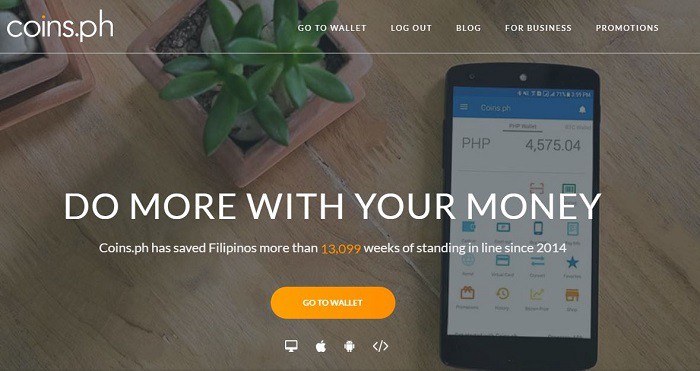

How to Buy and Sell Bitcoins Using Coins.ph

Coins.ph allows you to top of your e-wallet to buy and sell Bitcoin. Read our guide to learn more about the platform’s advantages and disadvantages.

(Updated October 2019) There are many ways to get Bitcoin. You can either mine or buy Bitcoins. But how can you buy Bitcoins in the Philippines? In this article, we will discuss using Coins.ph.

Overview

While there’s an extensive list of places you can buy Bitcoin online, we in the Philippines have the option to top up cash to popular crypto wallets like Coins.ph, which is where we can convert pesos to Bitcoin.

One such website where you can buy and sell Bitcoins is BSP-accredited Coins.ph. Using their site, it is easy for you to convert your pesos into Bitcoin (and vice versa). What’s more, you do not need a bank account or credit card to do so. And while banks do not often allow you to deposit during Saturdays and Sundays, with Coins.ph, you can buy Bitcoin on weekends.

Note that you can also buy and sell cryptocurrency like Bitcoin cash and ethereum as well on this platform.

How to Buy Bitcoins using Coins.ph

- Sign up here.

- Don’t forget to link your mobile number. You will need it.

- Top up your account.

- Go to 7-Eleven’s Cliq Kiosk and specify the amount you want to put on your Coin.ph wallet.

- Pay the amount to the counter.

- The money should then be reflected to your wallet within minutes (sometimes immediately).

- Go to the Coins.ph app (or Coins.ph website).

- Use the convert button to turn the peso amount into Bitcoins.

That’s it!

How to Sell Bitcoins using Coins.ph

- Click your Bitcoin wallet.

- Click “Convert”.

- Specify the amount in Pesos that you want to be converted from BTC.

Advantages of using Coins.ph

- Cash in using 7-eleven. 7-eleven has thousands of stores in Metro Manila and all over the Philippines. There are other cash-in options available

- Easy quick conversion tool within the app.

- Coins.ph is recognized by the Bangko Sentral ng Pilipinas. This means the business is legally authorized to operate.

- Also because of this, you can safely link your bank account so that you can immediately buy Bitcoins with BPI, Union Bank, and Security Bank.

- It has VCE license and e-money license, allowing it to legally convert Bitcoin to other digital currencies. It also offers financial services such as payment of bills, mobile load, etc.

Disadvantages of Coins.ph

- There’s a convenience fee. However, this is still low compared to trying to buy Bitcoins on foreign Bitcoin exchanges.

- Needs KYC (Know your Customer). This means Coins identify who you are and asked about your income source. Some people may think this is too sensitive to share, and it really is. But Coins also need to make sure its service is not used by people who want to engage in dubious transactions, which might also affect other customers.

- Users complain that their buy and sell rates are widely spread out. i.e. the purchase price of 1 bitcoin is always points above the ongoing global rate found in CoinMarketCap.

With Bitcoin as both private and transparent, some people might not be comfortable with Coins.ph asking for their users to be KYC’d. However, this is something that the BSP instructed Bitcoin services in the Philippines to do. More about this on the next topic:

Coins.ph Cash In and Cash Out Limits and Verifications

Coins Cash In Fees

| Cash In | |

| Payment Method | Fees |

| 7-Eleven 7-Connect |

P100 – free

P101 – P20,000: 2% of the deposit |

| 7-Eleven CLiQQ Kiosk |

P100 – P20,000: 2% of the deposit

|

| Bayad Center |

P50 – P100: free

P101 – P50,000: 2% of the deposit |

| BPI (via Dragonpay) |

P15 – P1000: P10 fee

P1,001 – P4,000: fee of 1% of deposit Above P4,000: P40 fee |

| Cebuana |

P100 and above: 2% of the deposit

|

| Chinabank (via Dragonpay) |

P15 – P1000: P10 fee

P1,001 – P4,000: fee of 1% of deposit Above P4,000: P40 fee |

| eTap | 3% of the deposit |

| Globe GCash |

P15 – P1000: P 10 fee

P1,001 – P2,500: fee of 1% of deposit |

| M Lhuillier ePay |

P15 – P1000: 5% M Lhuillier fee + P10 Coins.ph fee

P1,001 – P4,000: P50 M Lhuillier fee + 1% Coins.ph fee Above P4,000: P50 M Lhuillier fee + P40 Coins.ph fee |

| Palawan Express Pera Padala | P1 – P500: P20 fee P501 – P5,000: P30 fee P5,001 – P50,000: P40 fee |

| Perahub | 2% of the deposit |

| Robinsons Business Center |

P15 – P1000: P10 fee

P1,001 – P4,000: fee of 1% of deposit Above P4,000: P40 fee |

| SM Bills Payment Center |

P50 – P1000: P10 fee

P1,001 – P4,000: fee of 1% of deposit Above P4,000: P40 fee |

| TouchPay |

P100 – P20,000: 2% of the deposit

|

| UnionBank of the Philippines |

FREE – 100% FEE REBATE

P15 – P1000: P10 fee P1,001 – P4,000: fee of 1% of deposit Above P4,000: P40 fee |

| Western Union |

P2,000 and below: Free for domestic cash ins in the Philippines

|

Coins.ph Cash Out Fees

| Cash Out | |

| Method | Payout Fee |

| Bank |

Free for branch of accounts within Metro Manila

|

| BDO Cash Card |

PHP 15.00 for PHP 100 up to PHP 25,000

|

| Globe GCash | 2% of the cash out amount |

| LBC Instant Peso Padala |

Minimum of PHP 60.00 (rates are calculated based on the cash out amount)

|

| LBC Pesopak (door-to-door delivery) |

Minimum of PHP 35.00 (rates are calculated based on the cash out amount)

|

| M Lhuillier Kwarta Padala | 1% of the cash out amount |

| Palawan Express Pera Padala |

Minimum of PHP 3.00 (rates are calculated based on the cash out amount)

|

| RCBC MyWallet | PHP 20.00 |

| Security Bank eGiveCash | Free |

Cash in limits based on account verification level:

| Verification Level | Description | Daily Cash In Limit (PHP) | Monthly Cash In Limit (PHP) | Annual Cash In Limit (PHP) |

| 1 | Email/phone verified | 2,000 | 50,000 | 50,000 |

| 2 | ID and selfie verified | 50,000 | 100,000 | 400,000 |

| 3 | Address verified | 400,000 | 400,000 | Unlimited |

| 4 | Custom verified | Custom | Up to 5,000,000 | Custom |

Cash out limits based on account verification level:

| Verification Level | Description | Daily Cash Out Limit (PHP) | Monthly Cash Out Limit (PHP) | Annual Cash Out Limit (PHP) |

| 1 | Email/phone verified | 0 | 0 | 0 |

| 2 | ID and selfie verified | 50,000 | 250,000 | 400,000 |

| 3 | Address verified | 400,000 | Unlimited | Unlimited |

| 4 | Custom verified | Custom | Up to 5,000,000 | Custom |

Verification per Level

- Level 1 – Valid Email Address and Phone Verification

- Level 2 – ID and Selfie Verification

- Level 3 – Address Verification

What you can do with your Bitcoins at Coins.ph

With your Bitcoins tucked at Coins, you can do either of the following

- Save and wait for the Bitcoin value to grow against fiat currency

- Send Bitcoin to other Bitcoin addresses

- Purchase Bitcoin and use it to buy from websites and shopping sites that accept it

- Convert it back to Peso on a favorable BTC to Peso exchange rate.

- Now, you can also buy, sell, trade, and convert your Bitcoin to PHP, Ether, XRP, and Bitcoin Cash.

Overall

Having an account in Coins.ph is one of the most simple ways to start engaging in Bitcoin transactions in the Philippines. With their verification system and approval from the BSP, there is safety guarantee for everyone who wants to use the service for dealing with Bitcoins and cryptocurrencies like ethereum and Bitcoin cash. While Coins used to have a debit card in the past, you can still pay your bills within the app.

Do you have a Coins.ph account? Do you have questions about it? Or do you use other Bitcoin services? Let us know in the comments below!

More Information about Coins.ph:

- phone number 02 692-2829 available from 10am – 6pm, Mondays to Fridays

- You can email help@coins.ph for support and assistance.

![[Bitget Research] How Previous Bitcoin Halvings Precede Record Price Highs 7 [Bitget Research] How Previous Bitcoin Halvings Precede Record Price Highs](https://bitpinas.com/wp-content/uploads/2024/02/Bitget-Research-How-Previous-Bitcoin-Halvings-Precede-Record-Price-Highs--768x402.jpg)

will coins.ph or any bitcoin transactions here in the philippines have an exchange platform where we can set buy/sell orders and set stop losses and set it via chart detail?

Hi Romille. Actually, check out this post: https://bitpinas.com/news/coins-ph-announces-cryptocurrency-exchange-coins-exchange-cx/ 🙂

will coins.ph or any bitcoin transactions here in the philippines have an exchange platform where we can set buy/sell orders and set stop losses and set it via chart detail?

Hi Romille. Actually, check out this post: https://bitpinas.com/news/coins-ph-announces-cryptocurrency-exchange-coins-exchange-cx/ 🙂

Can you transfer BTC from one account to another with a level 1 verification account?

I think you need atleast level 2 for cashing out. https://support.coins.ph/hc/en-us/articles/201305154-How-can-I-increase-my-daily-transaction-limits-