[Confirmed] Drift Protocol Airdrop Guide | Solana-based DEX

Check out our guide on Drift Protocol on Solana, and how to prepare for the airdrop.

![[Confirmed] Drift Protocol Airdrop Guide | Solana-based DEX 1 Photo for the Article - [Confirmed] Drift Protocol Airdrop Guide | Solana-based DEX](https://bitpinas.com/wp-content/uploads/2023/12/Potential-Drift-Protocol-Airdrop-Guide-Solana-based-DEX-1.jpg)

Updated April 22, 2024. Please check the airdrop section.

One advantage of decentralized exchanges over centralized exchanges is that they are more secure and less exposed to potential fraud and hacking accidents.

A Solana-based DEX then existed, allowing users to trade perpetual futures, spot tokens, borrow and lend, and provide liquidity on the blockchain while prioritizing security.

(Read more: Ultimate Guide to Solana Airdrops 2023 – 2024 and 10 Potential Crypto Airdrops to Watch Out For in 2024)

Table of Contents

Drift Protocol Introduction

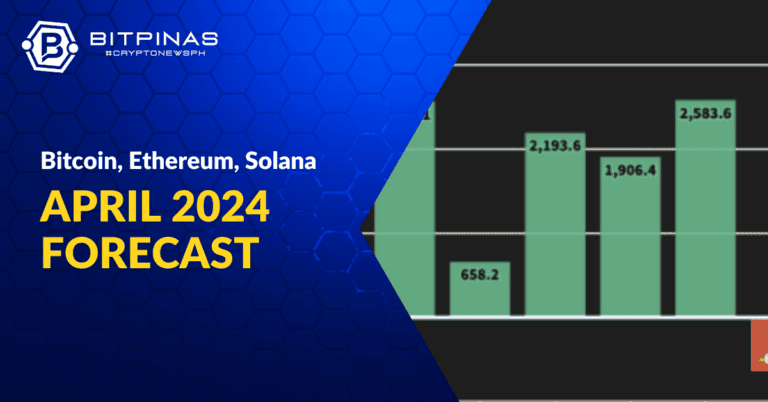

The Drift Protocol is a DEX that supports low slippage, low fees, and minimal price impact on all trades. It offers features such as spot trading, perpetuals trading, lending, and passive liquidity provision.

Drift also uses a cross-margined risk engine, a keeper network, and multiple liquidity mechanisms to offer low fees, low slippage, and high performance.

According to the team, on-chain exchanges suffer from limitations associated with blockchains—namely, speed and limited computational capacity on-chain.

Thus, Drift was designed as an exchange that is “robust, computationally efficient, and incentivizes market maker participation, as well as liquidity provision.”

Drift Protocol Features

![[Confirmed] Drift Protocol Airdrop Guide | Solana-based DEX 8 Photo for the Article - [Confirmed] Drift Protocol Airdrop Guide | Solana-based DEX](https://bitpinas.com/wp-content/uploads/2023/12/Potential-Drift-Protocol-Airdrop.jpg)

As a DEX, a Solana wallet is needed and should be connected to use Drift’s products and services. Its utility token is also $SOL, which means transaction fees are paid through $SOL tokens.

- To trade spot tokens, go to the spots trading section, choose the token or pair to be traded, type in the desired amount, and choose the “buy” or “sell” buttons. The order book, the chart, and the recent trades can also be accessed on the platform.

- To trade perpetual futures, go to the perpetual futures section, choose the token or pair to be traded, type in the desired amount, choose the leverage percentage, and choose the “buy” or “sell” buttons. The funding rate, the liquidation price, and the PnL can also be accessed on the feature.

- To borrow or lend, go to the lending section, choose the token to be borrowed or lent, type in the desired amount, and choose the “borrow” or “lend” buttons. The interest rate, the collateral ratio, and the available balance can also be accessed on the section.

- To provide liquidity, go to the liquidity section, choose the desired pool, type in the desired amount, and choose the “deposit” button. The pool size, the fee rate, and the APY can be accessed on the feature.

- To stake, go to the staking section, choose the token to be staked, type in the desired amount, and choose the “stake” button. The staking rewards, the lockup period, and the unstake fee can also be accessed in the same section.

[Confirmed] Drift Protocol Airdrop

![[Confirmed] Drift Protocol Airdrop Guide | Solana-based DEX 9 Photo for the Article - [Confirmed] Drift Protocol Airdrop Guide | Solana-based DEX](https://bitpinas.com/wp-content/uploads/2023/12/Drift-Airdrop-Drift-Points.jpg)

- Introduction of DRIFT Token and DAO: The Drift DAO Foundation has introduced the DRIFT governance token, aimed at empowering users and contributors to actively participate in decision-making processes within the Drift ecosystem, a leading DeFi project on Solana.

- Governance and Decentralization: The DRIFT token allows holders to influence Drift’s long-term vision and development. The Drift DAO consists of multiple branches: a Realms DAO for general development, a Security Council for governance, and a Futarchy DAO for funding innovations.

- Token Allocation and Distribution: Of the 1 billion DRIFT tokens to be distributed over five years, 53% are reserved for the community, 43% for ecosystem and trading rewards, with specific allocations for protocol development and strategic participants.

- Next Steps and Precautions: The upcoming steps include a launch airdrop for eligible users, outlined in a forthcoming blog post. The foundation advises caution against scams and unauthorized solicitations, underscoring the importance of security in community interactions.

Who is eligible for the Drift Airdrop?

Thetokens will be distributed to Drift users in recognition to their historical contributings to the project. Eligible users are the following:

- Long-standing users

- Participants in programs like BAL or Insurance Fund on the platform.

- Contributions to the protocol through deposits

- Active engagement as liquidity providers.

When is the airdrop going to happen?

Drift will publish a blog post outlining the airdrop eligibility criteria. There will also be a claim period when eligible users can get their Drift governance tokens.

This article is published on BitPinas: Potential Drift Protocol Airdrop Guide | Solana-based DEX

Disclaimer:

- Before investing in any cryptocurrency, it is essential that you carry out your own due diligence and seek appropriate professional advice about your specific position before making any financial decisions.

- BitPinas provides content for informational purposes only and does not constitute investment advice. Your actions are solely your own responsibility. This website is not responsible for any losses you may incur, nor will it claim attribution for your gains.