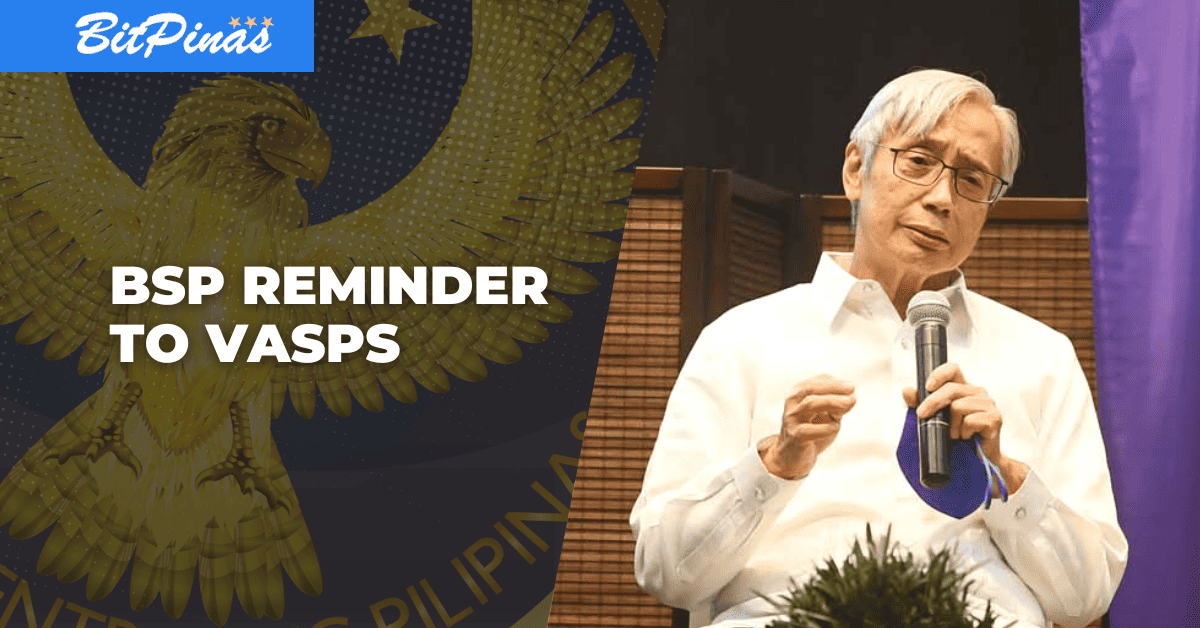

BSP to Licensed Crypto Exchanges: Don’t Misuse User Funds

Citing the BSP Circular No. 1108, the central bank emphasized that virtual asset services providers must not lend out user funds.

Subscribe to our newsletter!

Editing by Nathaniel Cajuday

- The BSP has issued a reminder about the importance of keeping virtual assets safe.

- Companies that provide services related to virtual assets must make sure customer funds are safe and not being used for other purposes.

- The BSP also wants these companies to have enough reserves to cover the virtual assets they hold, and to keep customer and company funds separate.

Following the tragic collapse of FTX, once one of the largest cryptocurrency exchanges globally, the Bangko Sentral ng Pilipinas (BSP) has recently issued a reminder on risk management measures relative to virtual asset safekeeping, liquidity requirements, and third-party engagements.

“In view thereof, the Bangko Sentral cautions all BSP-licensed Virtual Asset Service Providers (VASPs), particularly those providing safekeeping and/or administration services for VAs (i.e., VA Custodian), to ensure that customer VAs are not being used for any business activities other than for safekeeping on the customers’ behalf.”

Bangko Sentral ng Pilipinas

Citing the BSP Circular No. 1108, the central bank emphasized that VA custodians, such as VASPs, are expected to ensure the adequacy of reserves for VAs held in custody and institute mechanisms to properly record and segregate customers’ VAs from their proprietary VAs.

Further, the monetary authority expressed that it is still cognizant of the emerging threats and developments in the virtual asset (VA) landscape, especially with the practices that endanger the safety and security of customer funds.

“Meanwhile, related-party transactions should comply with appropriate reporting and disclosure requirements in accordance with relevant regulations and standards,” the BSP added.

Accordingly, the central bank stressed that VASPs must employ robust risk management systems and practices in managing their liquidity, third-party, and operational risks, among others.

“VASPs that facilitate the conversion or exchange of fiat currency to VA or vice versa are expected to maintain sufficient unencumbered liquid assets to ensure that VA redemptions are adequately met at all times,” it stated.

In addition, the monetary authority also reminded VASPs that engage with third-party liquidity providers to adopt appropriate due diligence procedures and conduct a periodic risk assessment.

“In determining the risk profile of liquidity providers, VASPs should consider important factors such as, the license/registration status, legal/supervisory framework of the jurisdiction from which the liquidity providers are domiciled, and Page 2 of 2 supervisory/enforcement capabilities of relevant regulatory bodies/enforcement agencies, among others. In addition, contingency funding plans should be established in the event of prolonged service delivery failure or untimely cessation of the third-party liquidity providers,” the BSP ruled.

Consequently, BSP recently confirmed to BitPinas that it has asked locally licensed cryptocurrency exchanges about their exposure to FTX. According to them, the initiative was to closely monitor the situation and work to ensure that local exchanges have adequate protection against any potential losses. (Read more: BSP Asks Local Exchanges of FTX Exposure)

The aforementioned FTX collapse, which started with a CoinDesk article, happened last month. After the exposure of the unbalanced assets of FTX, its rival Binance announced that it will liquidate its FTT holdings. Following this, Binance CEO Changpeng Zhao denied conspiracy allegations and even signed a non-binding agreement to acquire the firm. However, Binance eventually dropped the bid because they deemed that “the issues are beyond our control or ability to help.” (Read more: What Happened? BlockFi Files for Bankruptcy Amid FTX Crypto Contagion)

This article is published on BitPinas: BSP to Licensed Crypto Exchanges: Don’t Misuse User Funds

Disclaimer: BitPinas articles and its external content are not financial advice. The team serves to deliver independent, unbiased news to provide information for Philippine-crypto and beyond.