Industry Players Share 2024 Crypto Market Predictions

Explore 2024 cryptocurrency predictions, including Bitcoin price forecasts, ETF approvals, regulatory shifts, and insights from global entities like VanEck and Forbes, alongside perspectives from local web3 leaders.

- Entities share their prediction for the cryptocurrency market for 2024.

- VanEck, Forbes, Matrixport, Bitwise Invest, and some of the county’s key opinion leaders shared bullishness for the year ahead.

As the new year begins, several cryptocurrency enthusiasts and investors are anticipating a more fruitful year, as opposed to the previous bearish years. Following these, numerous crypto entities have shared their market prediction for the year ahead.

Table of Contents

2024 Crypto Market Predicitions

Van Eck

Before 2023 ended, Investment firm VanEck shared its 15 crypto predictions for 2024.

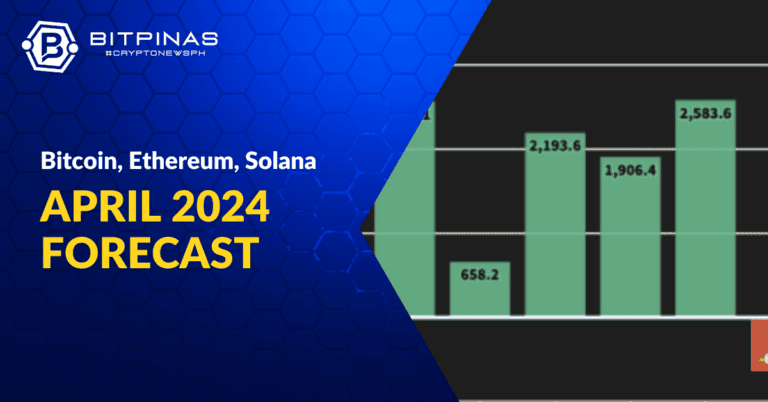

These include expectations of a US recession alongside the arrival of the first spot Bitcoin exchange-traded funds (ETFs), with over $2.4 billion potentially flowing into these ETFs in Q1 2024. The 4th Bitcoin halving is predicted to have minimal market disruption, leading to a post-halving rise in Bitcoin’s price.

Additionally, VanEck noted that it projects Ethereum to reach an all-time high in Q4 2024, driven by political events and regulatory shifts following a US presidential election. It also stated that Ethereum will outperform major tech stocks, Ethereum Layer 2s will capture the majority of EVM-compatible TVL and trading volume post EIP-4844 implementation, and non-fungible token (NFT) activity will rebound to an all-time high.

The firm also anticipated that Binance will lose its #1 position for spot trading, stablecoin market cap reaching above $200 billion, and decentralized exchanges (DEXs) hitting all-time highs in spot trading market share.

Moreover, remittances are expected to boost blockchain use, and a breakout blockchain game may surpass 1 million daily players. Solana is projected to become a top 3 blockchain by market cap, and DePin networks like Hivemapper and Helium are expected to see increased adoption.

Finally, new accounting standards are anticipated to bolster corporate cryptocurrency holdings, and KYC-compliant (know-your-customer) DeFi applications, led by Uniswap, may surpass non-KYC ones, attracting institutional volume and boosting protocol fees.

(Read: A Year after its ATH, Can Bitcoin Reach $69,000 in 2024?)

Forbes

Forbes contributor Sean Stein Smith, a professor at the City University of New York – Lehman College and actively involved in various blockchain and technology-related advisory roles, shared his crypto market prediction for 2024.

According to him, this year there will be improvements in accounting rules, particularly with the issuance of the long-awaited crypto accounting rule by the Financial Accounting Standards Board. This rule allows firms holding crypto to report assets at fair market value, promoting transparency and mainstream adoption.

Another anticipated development is the approval of a spot bitcoin ETF, with several proposals under review at the U.S. Securities and Exchange Commission (SEC). He noted that this approval is expected to add legitimacy to bitcoin, encourage transparency, and foster a more mature conversation about cryptoassets.

On the other hand, Smith stated that Tether, the largest stablecoin, is set to face increasing regulatory scrutiny, and suggest it will either undergo auditing or be deplatformed due to concerns about transparency and regulatory compliance.

Moreover, he predicted that the U.S. banking sector will embrace tokenized payments, with major financial institutions and payment processors already making strides in this direction.

As for Bitcoin’s price, a conservative estimate suggests it will likely surpass $60,000 in 2024, marking a healthy recovery for the sector.

Matrixport

In late 2023, Matrixport Research has reiterated its Bitcoin price predictions, anticipating a surge to $63,140 by April 2024 and a year-end target of $125,000.

The firm bases its forecast on historical analysis, considering past bear markets and mining reward halving cycles, supporting the expectation of a three-year bull market, with a significant positive trend in 2023. The report highlights macroeconomic factors like anticipated interest rate cuts and declining inflation as key drivers for Bitcoin’s upward trajectory in 2024.

Moreover, in a recent analysis, Matrixport attributed potential price surges to the introduction of Bitcoin Exchange-Traded Funds (ETFs), a year-end rally, consistent BTC acquisitions during U.S. trading hours, and a favorable macroeconomic environment. The firm previously predicted a year-end target of $56,000 for BTC based on historical patterns.

Bitwise Invest

Ryan Rasmussen, a researcher at Bitwise Asset Management, shared eleven predictions of how the firm envisions 2024 will unfold for the crypto sector.

The firm anticipates that Bitcoin will trade above $80,000, reaching a new peak. This surge is attributed to two key factors: the awaited launch of a spot Bitcoin ETF in early 2024 and the halving of new bitcoin supply at the end of April. The combined impact of these catalysts is expected to bolster Bitcoin’s value significantly.

In the realm of financial instruments, Bitwise Invest predicted that spot Bitcoin ETFs will not only gain approval but also become the most successful ETF launch in history. The estimate suggests that within five years, these ETFs could capture 1% of the $7.2 trillion U.S. ETF market, translating to $72 billion in assets under management (AUM).

In contrast, Ethereum is projected to experience a more than two-fold increase in revenue, reaching $5 billion. This growth is attributed to a surge in user engagement with crypto applications on the Ethereum network. An Ethereum upgrade (EIP-4844) is also expected to drive the average transaction cost below $0.01, facilitating the development of more mainstream applications in the crypto ecosystem.

“Coinbase’s revenue will double, beating Wall Street expectations by at least 10x. Historically, Coinbase’s trading volumes surge in bull markets, and we expect the same to happen again. Plus, they’ve launched a wide range of new products that are showing traction,” Rasmussen wrote.

Furthermore, stablecoins, which the firm noted as a “killer app” in the cryptocurrency market, are projected to settle more money than Visa. The stablecoin market has seen significant growth, reaching $137 billion in the past four years, and this trend is expected to continue in 2024.

In the traditional finance sector, JPMorgan is expected to tokenize a fund and launch it on-chain, which is in line with the broader trend of Wall Street’s increasing interest in tokenizing real-world assets for enhanced efficiency and market participation.

“Taylor Swift will launch NFTs to connect with fans…One possibility? Spotify—where Swift was the most-streamed artist in 2023 with more than 26b streams—is experimenting with token-gated playlists that require listeners to own a particular NFT in order to listen,” the firm speculated.

As a bonus prediction, Rasmussen stated that it is anticipated that 1 in 4 financial advisors will allocate to crypto in client accounts by the end of 2024, reflecting the growing acceptance and integration of cryptocurrencies into traditional financial portfolios.

Local KOLs

In a Year Ender Special BitPinas Webcast, local web3 leaders shared 2024 predictions.

Henry Banayat, Director at Bitshares Labs, expects increased regulations, especially if a bull run occurs. Trexia Olaya sees greater compliance in the cryptocurrency sector and anticipates more local enterprises exploring blockchain integration.

Luis Buenaventura, Assistant VP at GCash, speculates on a five to ten times growth in the crypto market, potentially reaching a $10 trillion market cap in 2024, emphasizing crypto’s validation.

Buenaventura also predicts NFT terminology evolution, focusing more on experiences and memberships. Despite changes, he notes the enduring popularity of web3 games and NFT art. Looking at the broader crypto industry, he anticipates a return to the financial instrument side with developments in DeFi, tokenization of treasuries, and innovations in money markets.

This article is published on BitPinas: Bullish or Bearish? 2024 Crypto Market Predictions

Disclaimer:

- Before investing in any cryptocurrency, it is essential that you carry out your own due diligence and seek appropriate professional advice about your specific position before making any financial decisions.

- BitPinas provides content for informational purposes only and does not constitute investment advice. Your actions are solely your own responsibility. This website is not responsible for any losses you may incur, nor will it claim attribution for your gains.

![[Update] E-Sabong Crypto? 12 ‘E-Sabong’ Sites Using Crypto as Bets, PNP Discovers 12 [Update] E-Sabong Crypto? 12 ‘E-Sabong’ Sites Using Crypto as Bets, PNP Discovers](https://bitpinas.com/wp-content/uploads/2022/05/E-SABONG_CRYPTO__Featured-1-768x402.png)