Wednesday Watch: Should Corporate Treasurers Consider Bitcoin?

I can imagine a stream of more bullish news in the coming days.

Good morning. After the Tesla price pump, the market turned to a frenzy. I can imagine a stream of more bullish news in the coming days.

Welcome to Wednesday Watch, part of our new series: BitPinas Daily. We will look at the price of Bitcoin, Ethereum and the major cryptocurrencies. Crypto is global, but sometimes news that matters happens while we sleep. So we bring to you what’s happening in our space here and abroad.

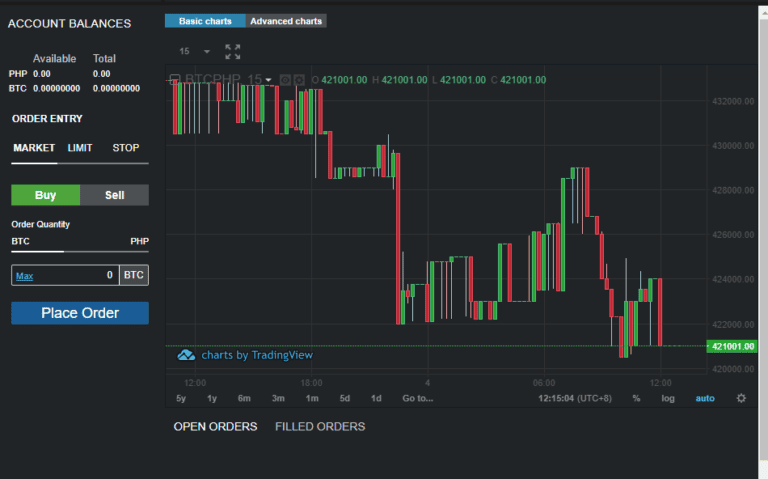

Market Price as of February 10, 2021:

| Bitcoin | $46,570 | +0.57% |

| Ethereum | $1,769.05 | +1.03% |

| Tether | $0.99 | -1% |

| DOT | $23.18 | +0.35% |

| Cardano | $0.70 | +2.94% |

| SLP | $0.031 | +13.7% |

Bitcoin closed February 9, 2021, at $46,570 per BTC. We’re up 31% in the last 7 days and up 60% since the year began. This is 3% below the previous all-time high of $48,025 which was hit on Feb 9. 2021.

Bitcoin’s market capitalization stands today at $866,567,008,739 which is 60% of the entire cryptocurrency market. The entire crypto market, by the way, now has a market cap of $1,427,445,588,957 (+3.1%).

On the table above, there’s the cryptocurrency SLP. If you wonder what that is, check out this article: Playing Axie Infinity vs Minimum Basic Salary in the Philippines.

Corporate

CNBC Host: Every Corporate Treasurer Should Be Thinking Bitcoin

“Every treasurer should be going to boards of directors and saying, ‘Should we put a small portion of our cash in bitcoin?’ It seems to be an interesting way to hedge against the rest of the environment,” Jim Cramer, CNBC host said.

“I think it’s an alternative to having a cash position where you make absolutely nothing,” Cramer said. The verdict on bitcoin: “Nice hedge against fiat currency.”

Ethereum

Ethereum Reaches $1,800, Passes $200B market cap

The latest gains could be attributed to expectations that Chicago Mercantile Exchange’s (CME) regulated ether futures would boost institutional participation. The CME futures contracts went live on Monday.

The bullish sentiment may have received a boost from the recent GameStop saga and turmoil in legacy markets underscoring what some say is a need for more democratization of finance. Ethereum’s blockchain dominates the decentralized finance (DeFi) space. (Omkar Godbole, Coindesk)

Bitcoin

MicroStrategy CEO Launches Free Crypto Course

Grayscale

Grayscale Says ETH is Money, Commodity, and Interest-Bearing Asset

- In the report titled “Valuing Ethereum” Grayscale cites the digital asset’s necessity as payment for transactions like smart contract deployment and trade execution as akin to money.

- As a consumable commodity: The necessity to use the cryptocurrency in order to change the blockchain’s state demonstrates the choice to use the word “gas” to denominate transaction fees was not a mistake. A person must pay to use the network.

- As an interest bearing asset: Grayscale is pointing to the cryptocurrency’s use in the much-anticipated Ethereum 2.0 upgrade, which allows users to stake the digital asset to secure the network in exchange for an ETH-based reward.

(By Owen Fernau, The Defiant)

What else is happening

- DeFi platform Yearn moves to restore exploited ‘vault’ less than a week after $11 million loss

- As Tesla Shareholders, JP Morgan and Goldman Sachs Are Now Exposed to Bitcoin

- DeFi wars heat up as Curve Finance TVL hits $3.99B, surpassing Uniswap

This article is published on BitPinas: Tuesday Trades: Elon Musk’s Tesla Invests $1.5 B in Bitcoin