CIMB Bank PH Time Deposit With 7.5% Interest Launched

CIMB Bank Philippines introduces MaxSave Time Deposit, a digital offering with interest rates of up to 7.5%.

- CIMB Bank Philippines launched a digital time deposit product, MaxSave Time Deposit, with interest rates of up to 7.5% per annum.

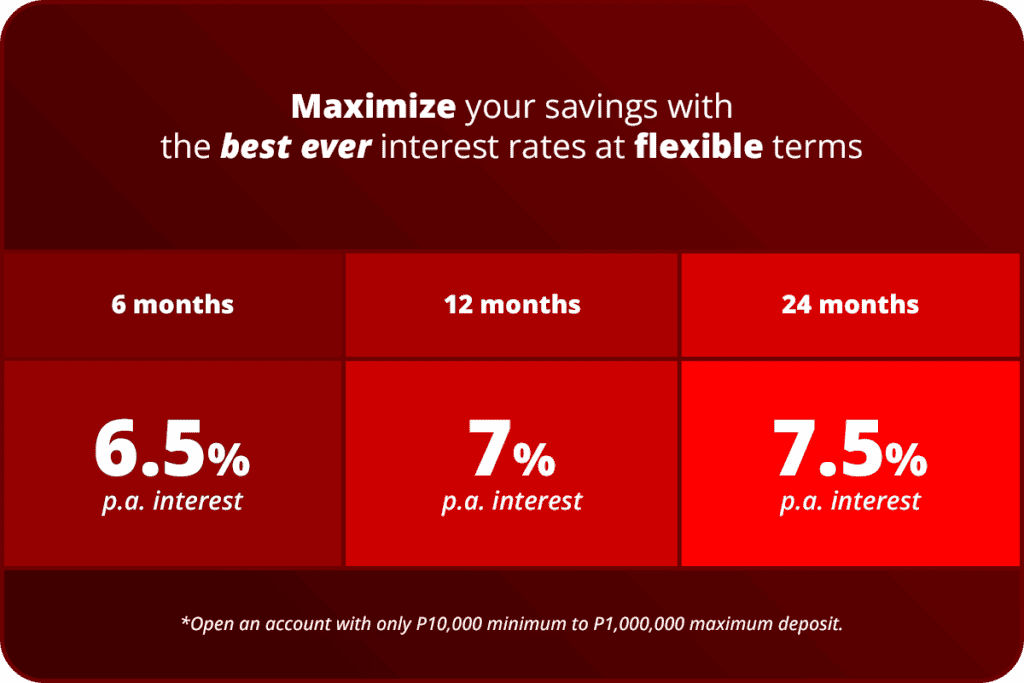

- The product offers three term options (6-month, 12-month, and 24-month) with corresponding interest rates, and clients can establish up to five accounts with a maximum balance of ₱1 million each.

- CIMB PH anticipates a high take-up due to the competitive interest rates, targeting at least 1 million time deposit customers in the first year and expecting a 25% annual growth in deposits and a 40% annual growth in credit services.

CIMB Bank Philippines, a solely digital commercial lender, has recently unveiled the launch of its time deposit product, offering interest rates of up to 7.5% per annum. The initiative aims to attract at least a million clients to utilize this service within its initial year of operation.

(Read more: List of Digital Banks With High Interest Rates in the Philippines)

Table of Contents

CIMB Time Deposit

The MaxSave Time Deposit offers three term options: a 6-month term with a 6.5% interest rate, a 12-month term with a 7.0% interest rate, and a 24-month term with a 7.5% interest rate. The minimum deposit amount is ₱10,000.

Clients are eligible to establish up to five-time deposit accounts, with each account having a maximum balance of ₱1 million.

According to the bank, this is secured by the Philippine Deposit Insurance Corporation (PDIC) for each depositor up to ₱500,000.

As per the terms, depositors participating in MaxSave can close their account before the term ends, but they will be subject to documentary stamp tax (DST), pre-termination fee (PTF), and other fees determined and communicated by CIMB.

If an account is closed within two days of creation, CIMB will return the full principal amount without interest earnings to the linked savings account, with no additional fees or taxes.

CIMB PH chief business and strategy officer Ankur Sehgal mentioned that the commitment to high-interest rates will be subject to periodic reviews, considering factors like Bangko Sentral ng Pilipinas policy rates, market rates, and competition rates.

Customer Goals

“We are targeting to have at least 1 million time deposit customers taking up in the first year, but I think based on projection, in the next three years we expect at least 50% of our customers to take up time deposit.”

Ankur Sehgal, Chief Business and Strategy Officer, CIMB PH

He also noted that with the high-interest rate, the bank expects a “very high takeup.”

In addition, Sehgal also noted that CIMB Philippines anticipates a 25% annual growth in deposits for the year, citing increased competition in the Philippine market. Further, the bank also aims for a 40% annual growth in its credit services.

Previous CIMB Promo

In July last year, CIMB Bank introduced the “Super Thank You Blowout Promo,” offering UpSave and GSave account holders the opportunity to earn interest rates of up to 12% on their incremental average daily balance growth. It ran from July 1 to 31, 2023—but it was extended for another month after the first deadline ended.

This article is published on BitPinas: CIMB Philippines Launches Time Deposit with 7.5% Interest

Disclaimer:

- Before investing in any cryptocurrency, it is essential that you carry out your own due diligence and seek appropriate professional advice about your specific position before making any financial decisions.

- BitPinas provides content for informational purposes only and does not constitute investment advice. Your actions are solely your own responsibility. This website is not responsible for any losses you may incur, nor will it claim attribution for your gains.