Liquidity Protocols: Rewarding Liquidity Providers Through Airdrops

Here’s a guide on a list of projects where you can provide liquidity and possibly earn some rewards at a future date.

Updated on March 16, 2024.

One of the goals of blockchain technology is the removal of a middleman or a central authority—which reflects decentralization. Among its examples is a decentralized exchange.

Decentralized exchanges have liquidity pools. As explained by #CryptoPH Champion Luis Buenaventura, a liquidity pool is a massive wallet holding two tokens. For instance, when a user wants to swap their $USDT to $ETH, their $USDT gets deposited into the pool and the $ETH gets withdrawn from it to be sent to the user’s wallet.

Basically, because DEXs have liquidity pools of different token pairs, decentralized trading, lending, and other DeFi services are enabled. But how do these liquidity pools get tokens? There are individuals who provide tokens to a smart contract that is associated with a liquidity pool—they are called liquidity providers.

(Read more: 24+ Potential Crypto Airdrops to Watch Out For in 2024 and Ultimate Guide to Solana Airdrops 2024 – How to be Eligible)

Table of Contents

Introduction to Liquidity Protocols

But it should be noted that these liquidity pools are not solely limited to a certain DEX. Normally, a liquidity pool is available to be used by the DEXs and other projects within a network or ecosystem. Because liquidity pools are certainly found on liquidity protocols.

Liquidity protocol is a set of rules, implemented through a smart contract, that is designed to execute the exchange of assets without intermediaries. A most known component of it are the Automated Market Makers (AMMs), which use liquidity pools to trade assets automatically without the need for market matching (like what centralized exchanges do). Most AMMs also find the pool with the best trade price.

Advantages of Being a Liquidity Provider

Though liquidity protocols create a safe environment for users to lend, borrow, and exchange tokens, they cannot function efficiently without liquidity providers.

Technically, a liquidity provider deposits an equivalent value of two tokens into a pool, after that, they will receive liquidity tokens that represent their share so they can still use the assets to other dApps.

Other protocols call this process staking (though we widely know that staking a certain token helps a network to be secured). This kind of staking means being a liquidity provider to a certain token pair.

For example, MilkyWay (https://www.milkyway.zone/), a liquid staking solution for Celestia’s TIA, allows users to stake $TIA and in return, they will get $milkTIA, which are liquidity tokens. $milkTIA can then be used across the DeFi projects in the Celestia ecosystem.

However, the benefits of a liquidity provider do not end there. The transaction fees paid by the pool and DEX users go to the liquidity providers. Most protocols also reward liquidity providers depending on how long users stake their tokens.

Airdrop Tips: Securing Rewards from Liquidity Protocols

Surprisingly, some liquidity protocols do not have their own tokens yet to reward providers. Thus, when they announce the launch of their own tokens, a massive airdrop surely happens.

Though these airdrops are merely community speculation, it is better safe than sorry. To qualify for the potential airdrops, it is a plus to always provide liquidity from the pools listed on these protocols. This is because some protocols in the past based the rewards given to their users according to how long they have been interacting with the platform and how big the volume of their transactions.

Some liquidity protocols also offer lending services, thus, borrowing or lending to these protocols could give points for potential airdrops. Lastly, liquidity protocols also have a “Bridge Asset” feature, which means that using this feature is also a plus to earn rewards.

But What Are These Protocols With No Token Yet?

Manta Network

Manta Network (https://manta.network/) is a multi-modular ecosystem for dApps using ZK proofs and offers two networks—Manta Pacific, a L2 ecosystem on Ethereum for EVM-native ZK applications, and Manta Atlantic, a ZK L1 chain on Polkadot that claims to bring programmable identities and credentials to web3 through zkSBTs.

In January 2024, Manta hosted its airdrop campaign called the “New Paradigm Penta Yield and Airdrop.”

March Update: Weeks later, the network then introduced its native token, $MANTA, where 11.20% of the token’s total supply was allocated for the airdrop rewards of two different campaigns, the Paradigm Penta Yield and a random airdrop.

For the Paradigm Penta Yield and Airdrop campaign, users will automatically receive their airdrop rewards on the wallet they used.

Read: Manta Network Ecosystem Guide and Airdrop Strategy

For a random airdrop, it is in line with the $MANTA launch. Those who were early users of the platform, active users of Atlantic, and zkApp users are said to be eligible. Claiming of rewards will be until June 18, 2024.

To check eligibility, go to https://airdrop.manta.network/.

Accepted wallets: MetaMask, WalletConnect, and Coinbase Wallet

Kroma Network

Kroma (https://kroma.network/) is a L2 solution that aims to develop a universal ZK Rollup based on the Optimism Bedrock architecture. According to its developers, the goal of Kroma is to eventually transition to a ZK Rollup once the generation of ZK proofs becomes more cost-efficient and faster.

In January 2024, it hosted an airdrop, which is called the “Kroma Quests.” It was a campaign to introduce the Kroma Ecosystem. Reaching a certain number of points grants a user NFTs.

March Update: Kroma seems to have rebranded itself and is now seeking to be the network for blockchain gaming.

As of this writing, Night Crows (https://kroma.network/ecosystem/nightcrows-event), a game built on top of Kroma, is promising those players who will reach level 45 will be available to receive airdrop rewards, such as $CROW, its in-game token, and $KRO, Kroma’s native token that is expected to be launched on the second quarter of the year.

Accepted Wallets: MetaMask

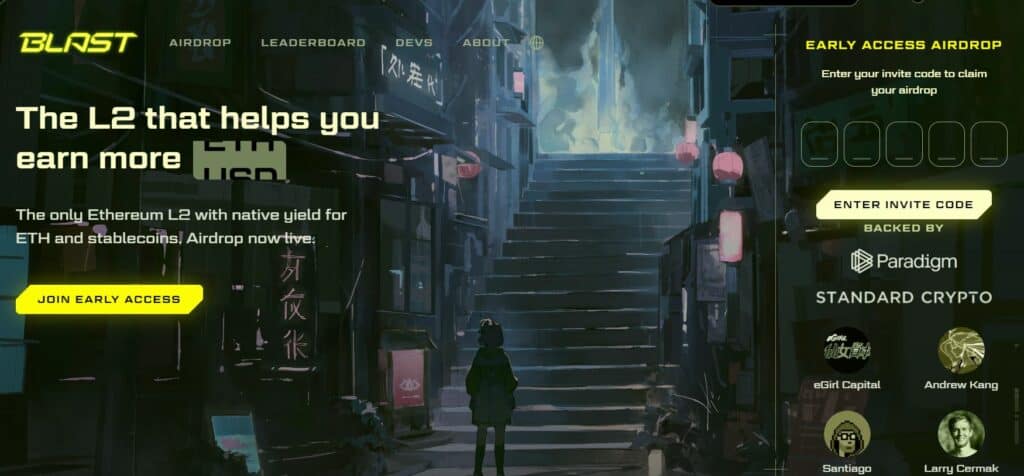

Blast

Blast (https://blast.io/en) is a L2 for Ethereum with native yield for ETH and stablecoins. It promises an interest rate of 4% for $ETH and 5% for stablecoins.

In January, it hosted an airdrop for those who would make an account and be its early members of its community.

March Update: The January airdrop is still active until now, especially for those who obtained an early access invite code. (https://blast.io/en/airdrop/sign-up)

Consequently, Blast’s mainnet is now publicly launched and a leaderboard is ongoing for those who will use the mainnet’s bridge feature, access the dapps within its ecosystem, and invite friends using a referral code. (https://blast.io/en/leaderboard)

Read: Blast Airdrop and Ecosystem Guide – How to Participate

Accepted Wallets: MetaMask, WalletConnect

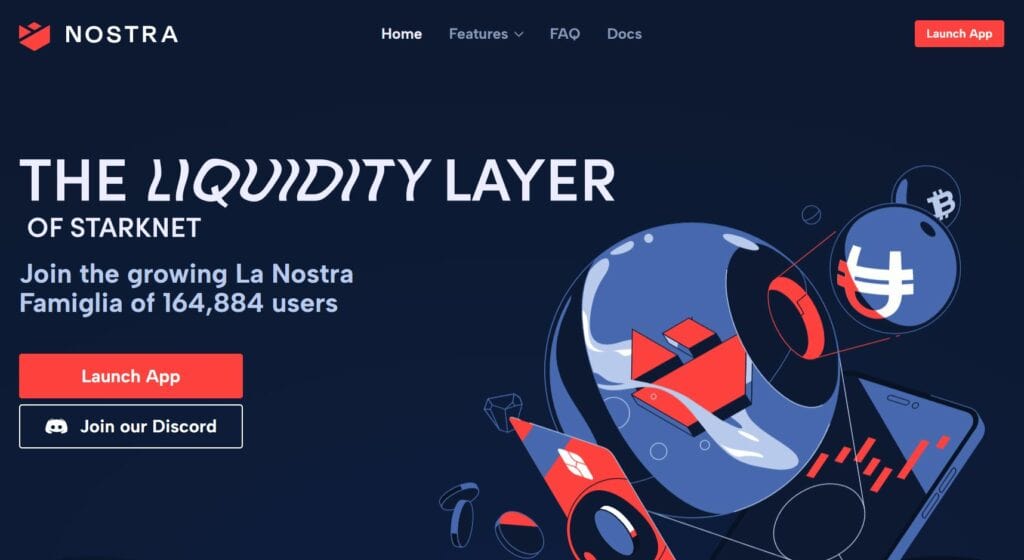

Nostra

Nostra (https://nostra.finance/) is a DeFi solution that allows users to lend, borrow, and trade crypto. As a protocol, it currently builds a liquidity layer on Starknet, “with retail mass adoption in mind.”

In January 2024, it had a points program for those who will lend, borrow, provide liquidity, and refer new users.

March Update: Those who joined the points system can now check their eligibility and claim their rewards at https://app.nostra.finance/claim.

Accepted Wallet: Braavos

Hubble

Hubble (https://hubbleprotocol.io/) is a newly launched protocol on the Solana Network. Within the platform, users can deposit tokens like SOL, ETH, and kTokens to borrow USDH, a stablecoin that can be used on the Solana ecosystem.

In January, BiPinas reported that its team shared that Hubble will soon offer multiple USDH borrowing vaults, with various asset combinations and vault-specific parameters such as Stability Fees and Deposit Caps.

This led for the community to speculate about an upcoming airdrop, especially Hubble continuing to upgrade.

March Update: Though the speculation has still not yet been confirmed, a leaderboard is now live that is based on a user’s collateral and debt. Hubble seems to follow a rank system, where rewards are expected to be based on rankings. (https://app.hubbleprotocol.io/leaderboard)

However, the rewards are not yet disclosed and an airdrop is not mentioned in the tokenomicsfor report of $HBB, Hubble’s soon-to-launch utility token.

Accepted Wallets: Solflare, Phantom, Backpack, Torus, and WalletConnect.

Balancer

Balancer (https://balancer.fi/) is an Ethereum-based AMM that claims to be designed to incorporate any number of swap curves and pool types. It offers “Passive LPs,” where users can utilize boosted pools to earn on top of their already compounding staked $AAVE.

Its airdrop is still community speculation. It is because though it already has its own native token, $BAL, it has not yet hosted any community-centered rewards program.

March Update: The tokenomics report for $BAL is already released and states that 65% of the total supply is allocated to the community. However, no airdrop is confirmed, instead, it seems that the rewards will be distributed to liquidity providers.

Accepted Wallets: MetaMask, WalletConnect, Coinbase Wallet

BENQI

BENQI (https://benqi.fi/) is a suite of decentralized finance protocols built on Avalanche. It consists of the BENQI Markets, which allows users to lend, borrow, and earn interest with their digital assets; BENQI Liquid Staking, which is an Avalanche liquid staking solution that tokenizes staked AVAX; and Ignite, which is designed to bootstrap Avalanche validators and Subnets.

In its whitepaper, there are no declared allocated tokens for community rewards, however, speculations say that its Liquidity Mining Program, which has an allocation of 45% of the total tokens, will soon be a part of the community rewards program.

March Update: BENQI Markets, a lending protocol within the ecosystem, is offering different pools where users can try to earn rewards in exchange for some tasks, including connecting a wallet and depositing a liquid token. (https://app.benqi.fi/rewards)

Accepted Wallets: MetaMask, Core, OKX Wallet, Coin98, WalletConnet, and Coinbase Wallet.

Marinade

Marinade (https://marinade.finance/) is a stake automation platform that claims to monitor all Solana validators and delegates to “100+ of the best-performing ones.” It allows its users to choose between staking natively or liquid stake SOL for mSOL, a liquid staking token.

It has its native token, $MNDE, but its whitepaper wrote that token allocation depends on its DAO. This makes the community speculate about some platform rewards.

March Update: It seems that the community has been heard as the platform is now hosting “Marinade Reward” (https://marinade.finance/app/rewards/).

During this campaign, participants can earn $MNDE by doing tasks such as connecting wallet, staking SOL, and other tasks.

Accepted Wallets: Phantom, OKX Wallet, Solflare, and Wallet Connect

This article is published on BitPinas: Liquidity Protocols: Rewarding Liquidity Providers Through Airdrops

Disclaimer:

- Before investing in any cryptocurrency, it is essential that you carry out your own due diligence and seek appropriate professional advice about your specific position before making any financial decisions.

- BitPinas provides content for informational purposes only and does not constitute investment advice. Your actions are solely your own responsibility. This website is not responsible for any losses you may incur, nor will it claim attribution for your gains.

![[Confirmed] Drift Protocol Airdrop Guide | Solana-based DEX 9 [Confirmed] Drift Protocol Airdrop Guide | Solana-based DEX](https://bitpinas.com/wp-content/uploads/2023/12/Potential-Drift-Protocol-Airdrop-Guide-Solana-based-DEX-1-768x402.jpg)

![[Interview] Ownly CEO Reveals Move to On-Chain Gaming 21 [Interview] Ownly CEO Reveals Move to On-Chain Gaming](https://bitpinas.com/wp-content/uploads/2023/12/Ownly-CEO-Reveals-Move-to-On-Chain-Gaming-768x402.jpg)